Lower Lows Signal Ongoing Weakness Despite Rising Market Attention

Dogecoin is struggling to stabilize as recent ETF-related buzz fails to translate into meaningful price recovery. While broader market sentiment briefly lifted interest in major memecoins, DOGE continues to face technical pressure, slipping into a deeper bearish structure.

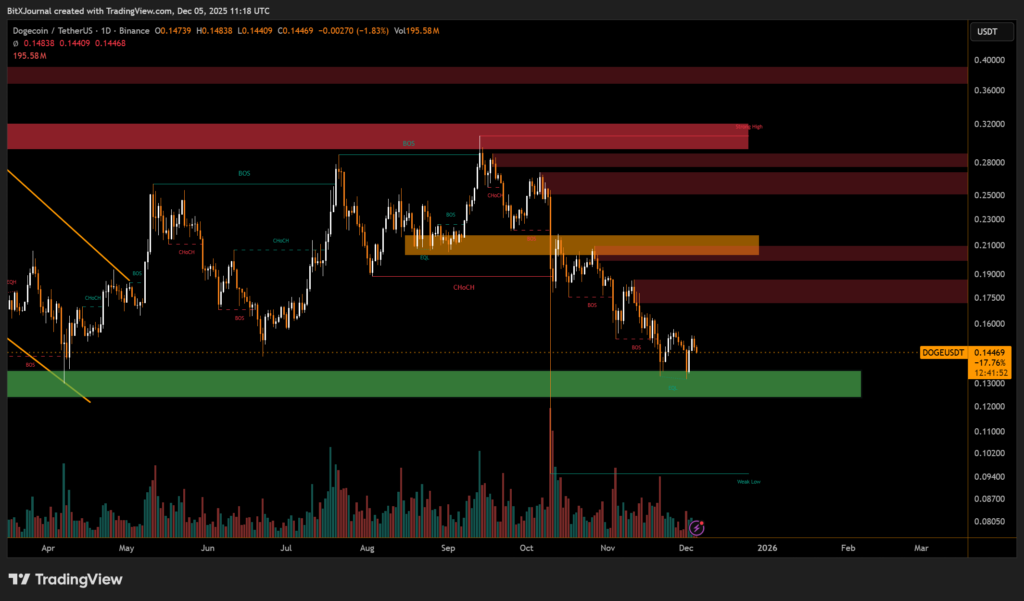

DOGE is currently trading near $0.144, marking another lower low after a series of failed attempts to reclaim short-term resistance. Recent price action shows the token losing grip on several intermediate support levels, reinforcing the downtrend that has persisted since late summer.

The market highlights a widening imbalance between supply and demand. DOGE remains below multiple zones of previous accumulation, notably the $0.160–$0.175 resistance band, where sellers have repeatedly absorbed buy-side attempts.

Unless price reclaims this area, broader momentum is likely to remain tilted to the downside.

Beneath current levels, the dominant support sits within the $0.130–$0.135 demand region, which has acted as a historical reaction point. This zone is now the final barrier preventing a deeper move toward the lower liquidity pools near $0.110.

The modest uptick in volume around recent lows suggests some buyers are attempting to defend the region. However, without a decisive recovery or structural shift, Dogecoin’s price remains vulnerable.

For now, DOGE must secure a strong close back above local resistance to avoid extending its downward trajectory.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.