Early institutional volume approaches $11 million, giving DOGE its strongest recovery signal since October

Dogecoin posted a 5% intraday rebound, snapping a multi-week losing streak after the debut of new DOGE-linked ETF products sparked renewed institutional attention. The move comes at a critical moment, with price action sitting just above a heavily contested demand zone where buyers historically defend aggressive dips.

Strong Technical Reaction at Key Support

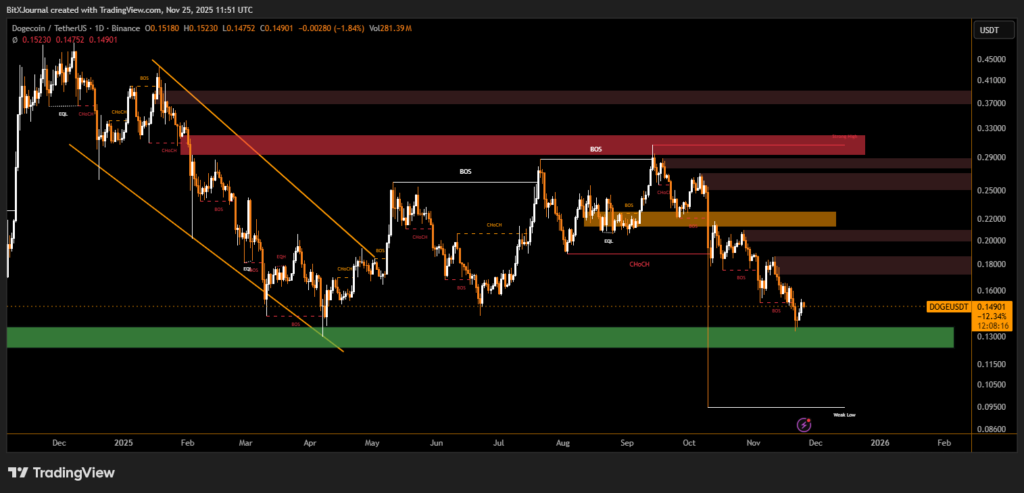

DOGE fell sharply earlier this month, touching the lower boundary of a broad green accumulation zone that has repeatedly acted as the last strong support before trend reversals. The market reacted firmly, producing a high-momentum bounce that technicians described as the first meaningful reversal signal in over six weeks.

According to BitXJournal market analyst, “the ETF launch created a much-needed catalyst at a time when DOGE was approaching structural exhaustion. The reaction from support confirms buyers are still active.”

BitXJournal market analyst noted that the bounce aligned with a clear Break of Structure (BOS) on lower timeframes — a pattern often observed near macro bottoms.

“This is the first time since early autumn that the chart shows a coordinated shift from distribution to accumulation,” the strategist added.

ETF Impact and Market Sentiment

The introduction of DOGE-linked ETF products drew immediate interest, with early estimates placing first-day volume near $11 million — a strong signal for a memecoin that historically relies on retail flows.

ETF researchers described the launch as a pivotal moment.

“Memecoin exposure through regulated products marks another step toward mainstream legitimacy,” one expert explained, saying that institutional participation could gradually stabilize DOGE’s usually volatile cycles.

Levels to Watch Ahead

DOGE remains below major resistance bands near $0.18, $0.22, and $0.29, where previous rallies have consistently stalled.

A close above the $0.18 mid-range zone would be the first confirmation that momentum is shifting in favor of buyers.

At the same time, the market continues to respect the $0.13–$0.12 demand block, which now stands as the most important support heading into December.

While DOGE’s broader trend remains fragile, the combination of ETF-driven volume and a high-confidence reversal pattern gives the asset its strongest recovery case since late summer. Traders now look to see whether institutional inflows can fuel a sustained breakout or if the rebound will fade at upper resistance.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.