DOGE rebounds from major demand zone despite muted reaction to ETF products

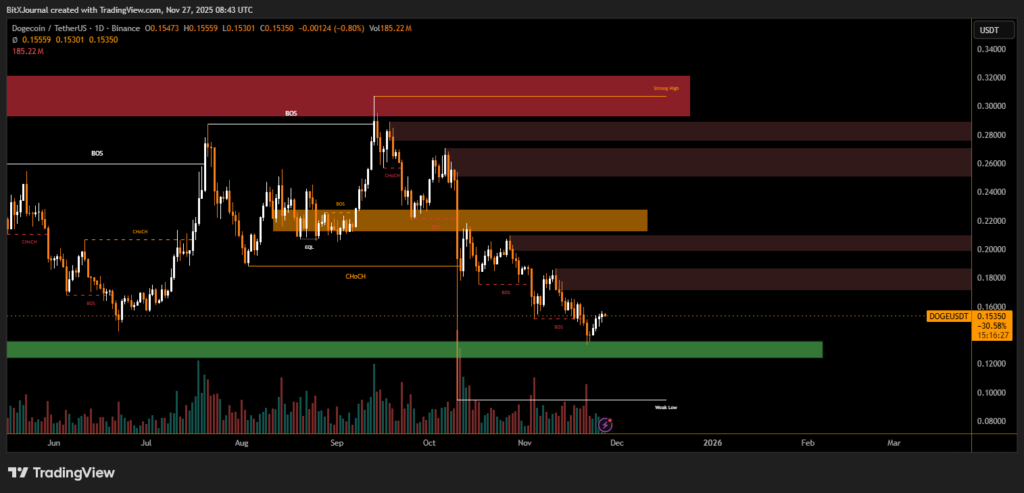

Dogecoin is beginning to display signs of structural improvement on the daily timeframe, forming a pattern of higher lows even as recent ETF launches delivered little excitement across the broader market. The latest price action shows DOGE rebounding from a crucial green demand zone near $0.13, a level that previously acted as a launch point for multi-week rallies.

Despite a 30% drawdown over recent weeks, technical indicators reveal that sellers may be losing conviction, with volume spikes signaling renewed buyer interest around established support.

DOGE Tests Demand Zone and Holds Key Structure

The market shows Dogecoin dipping into a heavy accumulation zone before bouncing, confirming that liquidity remains concentrated at the $0.12–$0.13 range. This region has consistently acted as a structural anchor throughout the year.

Multiple breaks of structure (BOS) and change-of-character (ChoCH) points across the chart highlight transitions between bullish and bearish regimes. The most recent BOS indicates that DOGE has pushed above minor resistance, opening the door for further upside if momentum continues.

BitXJournal Market analyst stated that “the reaction at this demand zone is telling. The higher low formation suggests accumulation rather than capitulation.”

He added that “if Dogecoin closes the week above $0.155, we could see price gravitate toward the first major supply band around $0.18.”

Volume Surge Signals Strength as Buyers Re-Enter

A notable increase in trading volume accompanied the latest upward move. Historically, volume spikes at lower levels have preceded larger impulsive rallies for DOGE.

Technical researcher Marissa Hale noted that “Dogecoin’s volume profile shows strong interest returning exactly where it needed to. This is often the first sign of a trend reversal, even before momentum indicators turn.”

Market highlights stacked supply zones between $0.18 and $0.26, followed by a broader distribution region near $0.32. For buyers, reclaiming these levels would confirm a full structural shift into a bullish cycle.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.