Dogecoin Struggles to Regain Momentum After Pullback from 2025 Highs

Dogecoin (DOGE/USDT) is showing renewed caution on the weekly chart after facing selling pressure near the $0.22–$0.30 resistance zone, pulling back to around $0.187 as of early November 2025. Traders are closely monitoring whether the meme-inspired cryptocurrency can maintain strength above its mid-range support before a potential next leg upward.

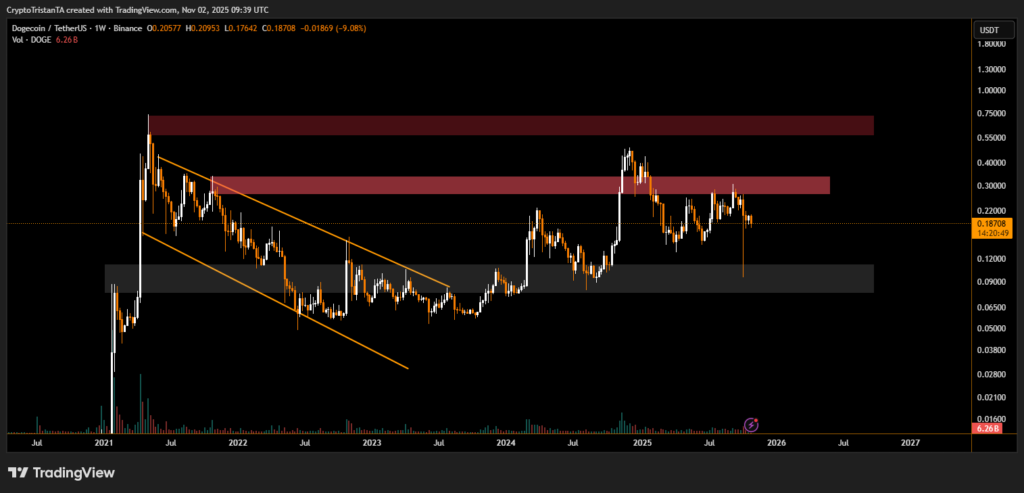

Over the past year, Dogecoin has transitioned from a prolonged downward channel, which dominated the 2022–2023 period, into a sideways consolidation phase. The breakout from the descending trendline in late 2023 signaled the end of the multi-year decline, but momentum has since slowed near key historical resistance zones.

Market data shows that Dogecoin’s primary support lies between $0.09 and $0.12, highlighted by previous accumulation and breakout levels. The upper resistance, marked between $0.30 and $0.35, has acted as a significant rejection area since mid-2024. The intermediate zone near $0.20–$0.22 is now a crucial pivot level for determining the next trend direction.

“Dogecoin needs to maintain weekly closes above $0.18 to preserve bullish structure,” said one BitXJournal market analyst. “A breakdown below that level could retest the $0.12 region, while a breakout over $0.22 might reignite momentum toward $0.30 and beyond.”

Trading volume, currently near 6.26 billion DOGE, reflects a moderate decline in speculative activity compared to earlier surges. Analysts note that such contraction often precedes larger directional moves. “Sideways action in this range tends to compress volatility before major expansions,” BitXJournal analysts observed.

In summary, Dogecoin’s weekly structure remains neutral to cautiously bullish as long as support holds above $0.18. A decisive move in either direction will likely determine whether the asset revisits its mid-2025 highs or slides back into its lower accumulation zone.

Dogecoin’s next move could define its mid-term trajectory for 2026 — the $0.18 line remains the key level every trader is watching.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.