Ethereum Faces Pressure After 5% Decline; Analysts Eye $3,600 as Crucial Zone

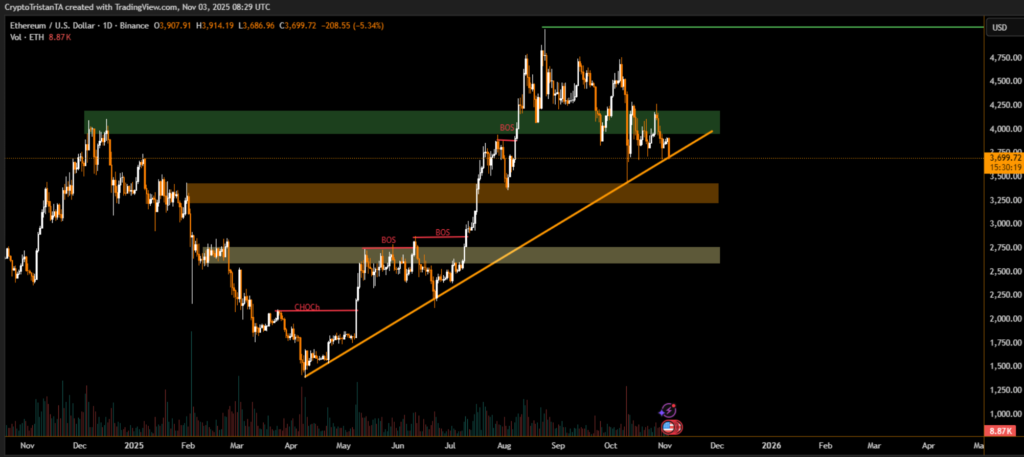

Ethereum (ETH) slipped below the $3,700 mark, falling by 5.34% in the past 24 hours as selling pressure intensified across the broader crypto market. The decline tested the lower boundary of the ongoing ascending trendline, which has guided Ethereum’s uptrend since early April.

The ETH/USD pair touched intraday lows of $3,686 before stabilizing slightly above the support trendline. The move signals a short-term loss of momentum after weeks of sideways trading between $3,700 and $4,100. According to chart data, Ethereum now sits at a make-or-break level, where a decisive close below $3,650 could trigger further downside toward the $3,400 demand zone.

“This is a key test for Ethereum’s mid-term structure,” said BitXJournal market analyst . “The price is still above trendline support, but momentum is weakening. A bounce from here would confirm the continuation of its higher-low pattern; however, failure to hold could shift sentiment bearish in the near term.”

Technical indicators reveal a change of character (CHOCH) and multiple breaks of structure (BOS), highlighting transitional phases in Ethereum’s recent market behavior. Despite the correction, ETH remains up significantly from its yearly lows, supported by steady on-chain activity and institutional interest in decentralized finance (DeFi) applications built on its network.

Volume data shows subdued participation, with traders awaiting confirmation before entering new positions. Analysts note that $3,900–$4,100 remains a significant resistance zone, where multiple rejections have occurred since September.

“A sustained move above $3,900 would reestablish bullish control and open the path toward $4,300,” BitXJournal strategist commented. “But if $3,600 breaks decisively, we could see a retracement back to $3,200 before any meaningful recovery.”

With Ethereum’s long-term trendline still intact, investors are closely monitoring this level as a potential inflection point—balancing between renewed accumulation or deeper correction.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.