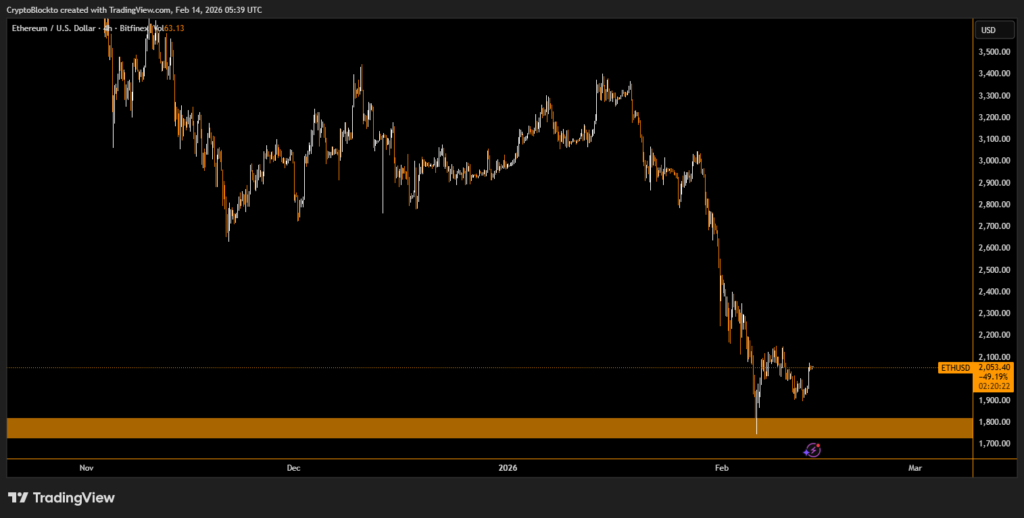

Ether is stabilizing near the $2,000 level, but weakening institutional flows and cautious macro sentiment are keeping traders on edge. The asset has struggled to maintain momentum above $2,150 since early February, increasing concerns that another leg lower could unfold.

Spot Ether ETF Outflows and Institutional Demand

US-listed spot Ether exchange-traded funds recorded $242 million in net outflows over two sessions, reversing brief inflows seen earlier in the week. While that figure represents less than 2% of the roughly $12.7 billion in total assets under management, it signals cooling institutional appetite.

At the same time, demand for short-term US government bonds has increased. The US 2-year Treasury yield slipped to 3.42%, reflecting expectations of further rate cuts in 2026. Lower yields typically indicate concerns about slowing economic growth, prompting investors to rotate toward perceived safety.

ETH Staking Yield, Supply Growth and Derivatives Sentiment

Ether has declined 38% over the past 30 days and remains 58% below its all-time high. The current staking yield of about 2.9% appears less attractive when compared to the Federal Reserve’s 3.5% target rate, especially as ETH supply expands at an annualized 0.8%.

Options data reinforces defensive positioning. The 30-day delta skew near 10% shows traders paying a premium for put options, signaling continued downside hedging.

Despite these pressures, Ethereum maintains the largest Total Value Locked among smart contract networks, suggesting that long-term fundamentals remain intact even as short-term volatility persists.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.