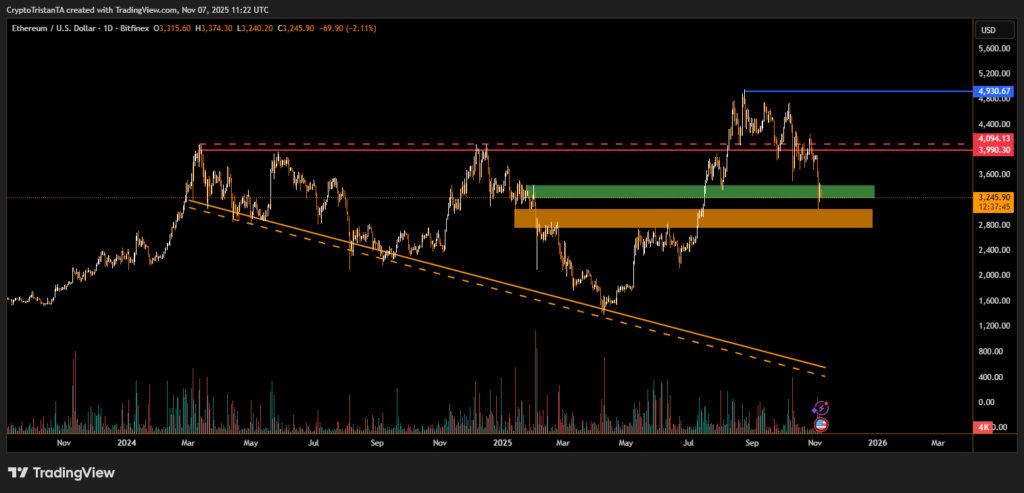

Despite a sharp price correction, analysts believe Ether’s current levels present a key accumulation zone as traders eye a year-end recovery toward $5,000.

Ethereum Enters Prime Accumulation Zone

Ethereum (ETH) may be on the verge of a major rebound, according to market analysts who describe the recent price drop as a potential “bear trap.” The world’s second-largest cryptocurrency has fallen over 13% in the past week, dipping to $3,099 before recovering to around $3,247, as per recent market data.

Michaël van de Poppe, founder of MN Trading Capital, said in a post that Ether’s correction went “a little deeper than expected,” but remains “a great area to accumulate positions on ETH.” His comments reflect a growing sentiment that the current dip could offer long-term investors a strategic entry point.

Traders Predict a Reversal Toward $5,000

Crypto trader Ash Crypto described the move as a “massive bear trap” and predicted that ETH could reach $5,000 before year-end, despite recent volatility. Another trader, known as Gordon, stated, “You are about to witness one of the greatest reversals we have ever seen on ETH.”

Ether’s recent decline follows a strong performance earlier this year, when it briefly approached $4,740 in early October. Analysts suggest that the ongoing consolidation could set the stage for a renewed uptrend, especially if Ethereum’s on-chain fundamentals continue to strengthen.

Diminishing Supply Could Trigger a Price Squeeze

Some analysts point to a “supply crunch” as a bullish factor, noting that the amount of ETH held on exchanges has been steadily declining, which historically precedes upward price movement. Reduced liquid supply, combined with staking growth and institutional interest, may support the next leg higher.

Despite broader market fear — reflected in the Crypto Fear & Greed Index’s “Extreme Fear” score of 24/100 — sentiment toward Ether is turning increasingly optimistic. Market intelligence data shows a rise in positive social activity after ETH briefly touched $3,500 on Thursday, sparking renewed confidence among traders.

While short-term volatility remains likely, most experts agree that Ethereum’s current levels represent strong technical support. As November historically delivers positive performance for Bitcoin, analysts expect Ethereum to follow suit — potentially confirming that the recent sell-off was less a trend reversal and more a temporary shakeout before recovery.

If momentum builds as predicted, Ether could be poised for one of its strongest rebounds of 2025, reinforcing its position as the leading platform for decentralized finance and smart contracts.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.