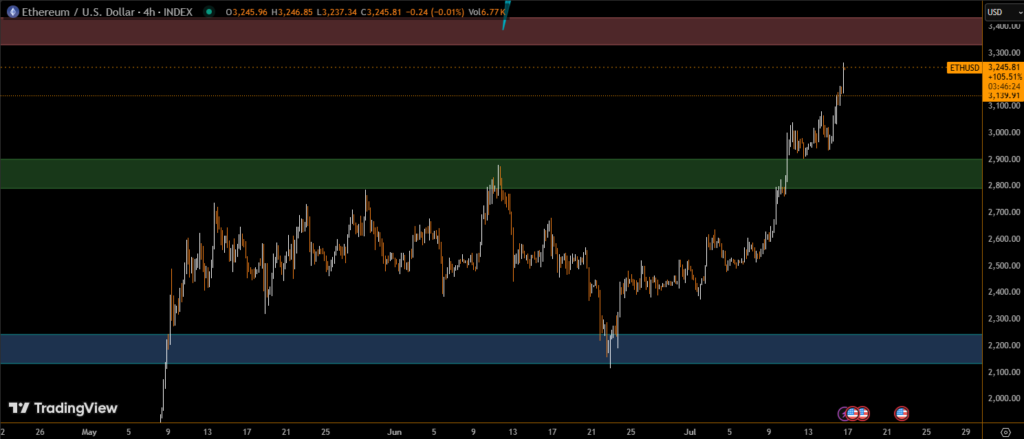

Ethereum’s native token, ETH, has taken the lead in the crypto market’s midweek rally, rising above $3,200 for the first time in over five months. The surge comes as institutional support, corporate treasury demand, and record spot ETF inflows drive renewed investor interest.

ETH Surges Past $3,200: A Five-Month High

Over the past 24 hours, Ethereum has climbed 6.5%, marking its strongest single-day performance in weeks. The token is now up 22% over the past seven days, reflecting a broader bullish sentiment supported by strong on-chain fundamentals and external catalysts.

This is the first time since early February that ETH has closed above $3,200, a level now considered critical support by many technical analysts.

Corporate Demand and ETF Inflows Fuel Ethereum Momentum

Ethereum’s bullish momentum is not just technical—it’s also being powered by a sharp uptick in institutional interest. Two major developments stand out:

- Spot ETH ETFs in the U.S. recorded over $900 million in inflows last week, accounting for nearly 29% of all ETH ETF flows in 2025, according to asset manager data.

- Corporate treasuries are entering aggressively. For instance, Sharplink Gaming (SBET) acquired over 74,000 ETH, with $257 million in cash reserves still available for further accumulation. Meanwhile, Bitmine Immersion (BMNR) disclosed ETH purchases totaling more than $500 million.

These acquisitions signal a broader shift in corporate finance strategies, where Ethereum is increasingly being seen as a strategic reserve asset, not just a speculative investment.

Bitcoin Rebounds Strongly After Dip to $116,000

While ETH leads the rally, Bitcoin has also shown resilience, bouncing back from a steep drop to $116,000 earlier in the week. BTC is currently trading near $118,695, up 2.6% in the past 24 hours.

Analytics firm Glassnode reported that investors aggressively bought the dip, accumulating approximately 196,600 BTC (worth over $23 billion) between $116K and $118K—indicating high confidence in Bitcoin’s long-term trend.

Conclusion: Ethereum Setting the Pace

With spot ETF inflows accelerating, corporate purchases ramping up, and technical resistance levels being broken, Ethereum is clearly leading the charge in the current market cycle. As long as macroeconomic sentiment remains supportive and on-chain demand holds, a sustained move beyond $3,400 appears increasingly possible.

For traders and investors alike, ETH’s breakout is more than just a technical rally—it’s a structural shift in capital allocation.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.