Ethereum has moved into a valuation range historically associated with market capitulation, reigniting debate over whether Ether is nearing a bottom or still faces further downside pressure.

Ethereum MVRV Z-Score Signals Capitulation

Recent on-chain data shows Ethereum’s MVRV Z-Score falling to -0.42, a level that typically reflects widespread selling and fear-driven market behavior. The MVRV Z-Score compares Ethereum’s market value with its realized value, helping analysts assess whether the asset is overvalued or undervalued relative to historical norms.

While the current reading confirms capitulation conditions, it remains above the deepest lows recorded during prior bear markets. Historical data shows Ethereum reached an extreme low of -0.76 in late 2018, suggesting that although selling pressure is elevated, it may not yet match past cycle bottoms.

Further Downside Risks Remain

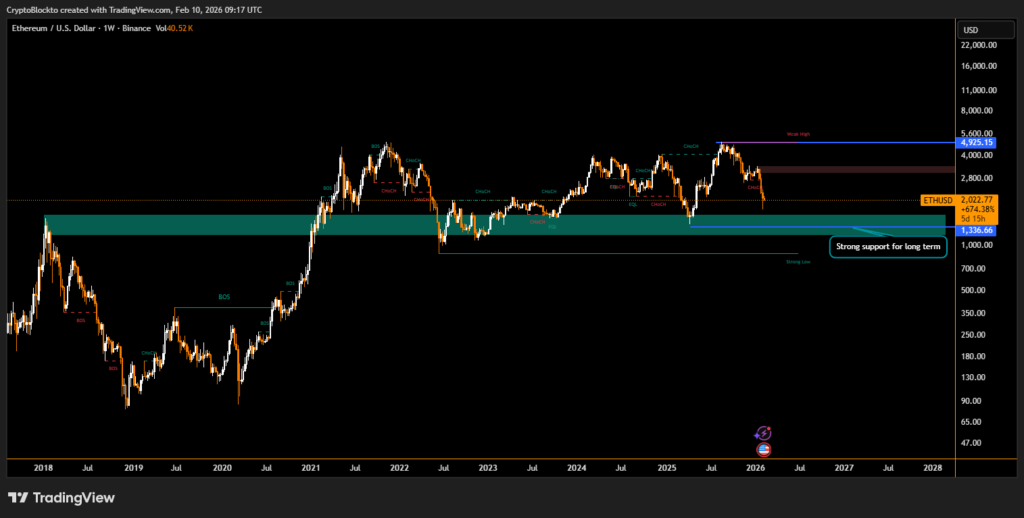

Ethereum’s price has declined roughly 30% over the past two weeks, recently touching a low near $1,825 before rebounding modestly above $2,000. Some analysts caution that macro pressures, including seasonal liquidity constraints tied to tax-related selling, could extend the current correction.

Long-Term Fundamentals Remain Intact

Despite short-term volatility, Ethereum’s broader network fundamentals continue to show resilience. Development activity, protocol upgrades, and ecosystem participation have not shown signs of structural weakness. Historically, extended periods of negative MVRV readings have often preceded strong long-term recoveries once selling pressure subsides.

Previous cycles indicate that similar valuation conditions occurred near major market lows, including during global risk-off events and crypto-specific crises. While timing a precise bottom remains difficult, current data suggests Ethereum has entered a zone that long-term investors have historically viewed as a strategic accumulation opportunity.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.