Ethereum (ETH) has shown notable price resilience in recent weeks, outperforming the broader cryptocurrency market by 17% over the last 30 days. While ETH has struggled to break above the $2,700 resistance since May 13, it continues to hold the majority of its weekly gains — even as Bitcoin (BTC) and altcoins face increased selling pressure.

Futures Market Shows Strong Confidence in ETH

ETH’s futures markets remain robust, with the 2-month annualized premium hovering around 6%, well within the neutral market range of 5–10%. This comes despite $159 million in liquidations of bullish leveraged positions between May 29 and May 30, indicating that long-term market sentiment remains intact.

Layer-2 Networks Amplify Ethereum Ecosystem Activity

Ethereum’s on-chain performance is bolstered by rapid growth in its layer-2 ecosystem, which is now handling over 15 times more transactions than the mainnet. Leading solutions like Arbitrum, Optimism, and Base continue to attract users and developers, reflecting strong ecosystem fundamentals despite overall crypto market uncertainty.

Ethereum Dominates DeFi TVL Amid DApp Fatigue

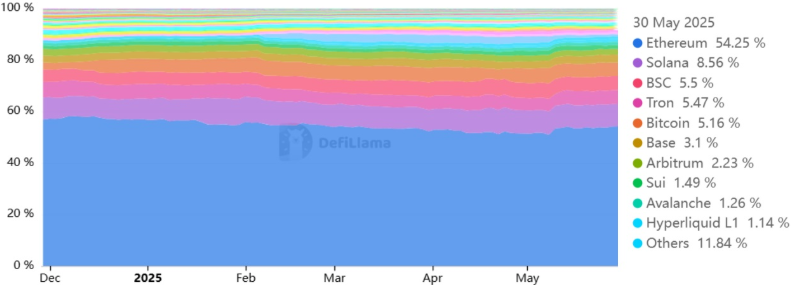

Despite concerns about decreasing decentralized application (DApp) engagement, Ethereum still commands a 54.2% share of the total value locked (TVL) across all blockchains, according to DeFiLlama. Combined with layer-2s, the Ethereum ecosystem captures over 60% of the entire DeFi market, far surpassing rivals like Solana and BNB Chain.

Ethereum’s top four DApps generated $169 million in fees over the past 30 days, while users paid $38.3 million in network fees — a healthy ratio supporting ETH demand. By contrast, Solana’s leading DApps brought in $356.3 million, but only $48.5 million of that went to the network, reflecting less direct benefit for SOL holders.

Short-Term Frustration, Long-Term Strength

While some investors express frustration over ETH’s stagnant price and lack of major upgrades, Ethereum’s strong fundamentals, scaling solutions, and active futures market paint a bullish medium-term picture. As macroeconomic uncertainty continues, Ethereum’s resilience and transaction dominance could give it a competitive edge in the next leg of the crypto cycle.