Ethereum may be nearing a critical turning point after its recent sharp decline, according to Fundstrat’s head of research Tom Lee, who argues that historical patterns suggest a swift rebound could follow.

Ethereum’s History of Sharp Declines and Fast Recoveries

Speaking at a conference in Hong Kong, Lee highlighted that since 2018, Ethereum has dropped more than 50% on eight separate occasions. In each instance, he noted, the asset staged what traders describe as a “V-shaped” recovery — rebounding at nearly the same speed as the decline.

Ethereum fell 64% between January and March last year, yet eventually recovered those losses. Lee believes the current downturn resembles previous cycles in 2018 and 2022, suggesting investors should focus on long-term opportunity rather than short-term panic.

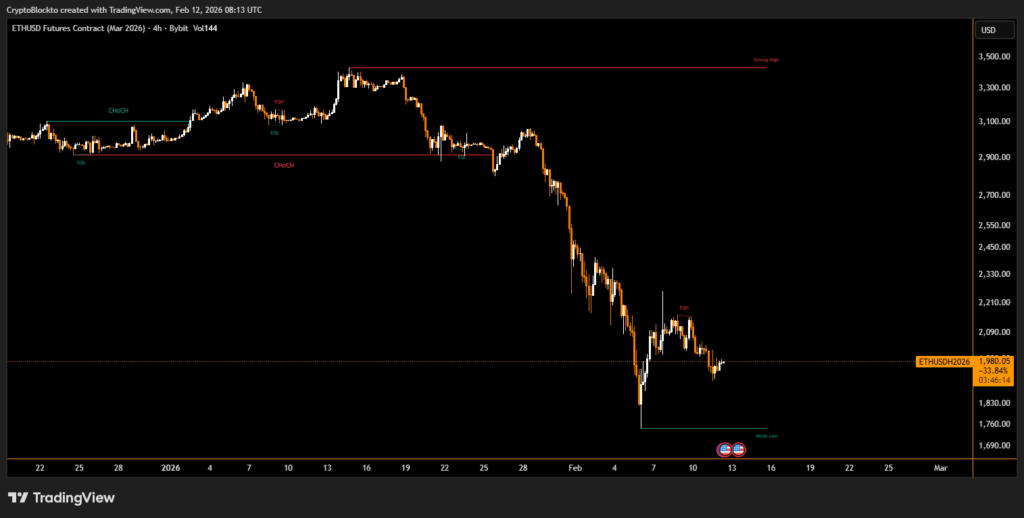

At the time of writing, Ether is trading around $1,970 after a 37% decline over the past 30 days. Earlier this month, prices briefly fell to $1,760, not far from the 2025 low near $1,400. Technical analyst Tom DeMark has identified $1,890 as a potential bottom zone.

Record Ethereum Staking Signals Long-Term Confidence

Despite price weakness, Ethereum’s fundamentals show resilience. Validator data indicates a record 4 million ETH are waiting in the staking entry queue, with wait times stretching to 71 days.

Approximately 30.3% of the total supply — about 36.7 million ETH — is now staked, effectively reducing circulating supply. Even with a modest 2.83% annual percentage rate, long-term holders appear committed, reinforcing the argument that Ethereum may be approaching another cyclical bottom.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.