Ethereum shows solid structure with rising demand zones, as analysts project new highs amid ecosystem dominance.

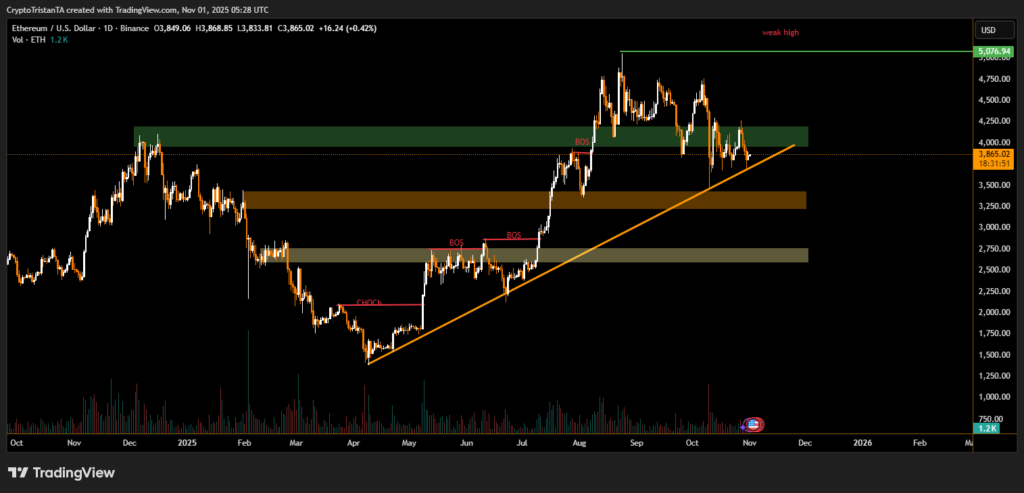

Ethereum (ETH) is holding strong near $3,860, maintaining its long-term ascending trendline support despite multiple attempts by sellers to push the price lower. The daily chart shows a clear structure of higher lows, signaling sustained market confidence even after recent corrections.

The next major resistance remains at $4,200–$4,300, aligned with a key supply zone that rejected prices twice in October. A break and close above $4,300 could pave the way for Ethereum to challenge its 2021 high near $5,076, marked as a “weak high” in the current technical setup.

Experts Expect a Breakout

BitXJournal Analysts are increasingly bullish on Ethereum’s midterm outlook. According to BitXJournal market researcher , “Ethereum continues to outperform most altcoins in terms of developer activity and network usage. The consolidation above $3,800 is a sign that large holders are accumulating before the next leg up.”

Grant added that institutional demand for ETH-based ETFs and the expanding DeFi ecosystem are reinforcing Ethereum’s market position. “We are witnessing a fundamental shift — Ethereum’s utility, staking yields, and scaling advancements are giving it a unique edge over Bitcoin,” he said.

On-Chain and Market Structure

On-chain data supports this technical view. Rising transaction volumes, steady staking inflows, and shrinking exchange reserves suggest investors are moving Ether into long-term holdings. These metrics indicate that selling pressure is fading, even as the broader market faces macroeconomic uncertainty.

The chart also shows multiple breaks of structure (BOS) and change of character (CHOCH) signals that confirm an ongoing bullish trend. Unless ETH loses the $3,600 demand zone, the bias remains upward with targets set at $4,300 and $5,000 respectively.

Ethereum’s dominance across decentralized finance, NFTs, and Layer 2 networks continues to grow, underscoring its role as the leading blockchain ecosystem.

As BitXJournal analyst Grant concluded, “Ethereum remains the most vibrant smart contract platform — and its price is simply catching up to the scale of its innovation.”

If the uptrend sustains above the ascending line, the next few months could see Ethereum retest $5,000, marking a key psychological milestone for both traders and long-term holders.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.