ETH breaks trendline, investors eye crucial levels for next move

Ethereum (ETH) slid to around $4,200 after breaking below a rising trendline, raising concerns about whether the second-largest cryptocurrency can maintain its bullish structure. The move comes as ETH faces profit-taking at higher levels and mounting technical resistance zones.

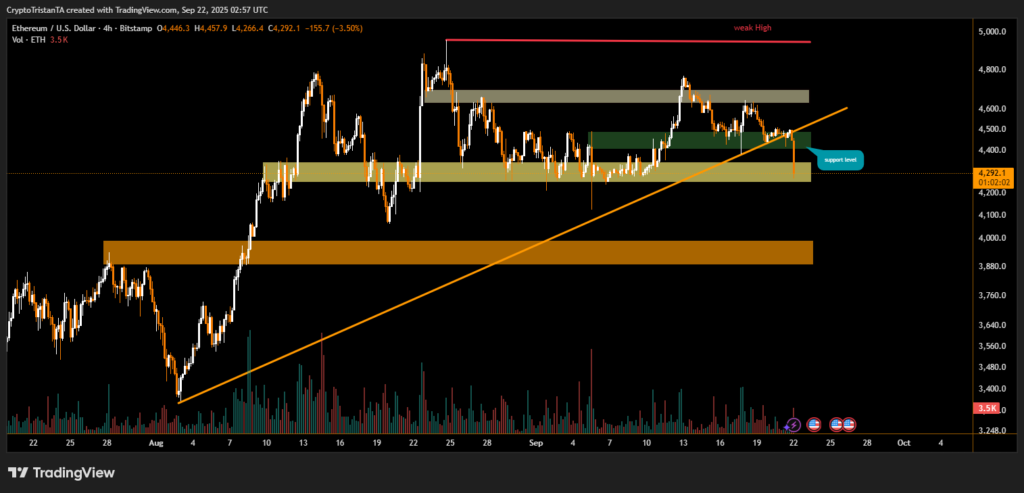

On the 4-hour chart, Ethereum recently tested the $4,450–$4,600 supply zone but failed to push higher, creating a rejection near the $4,800 level. Following that move, ETH lost momentum and dropped beneath its ascending trendline, a signal that bullish strength may be weakening in the short term.

The current decline has pushed the asset toward the highlighted support level at $4,200–$4,250. This region has been marked as a key demand zone where buyers previously stepped in to reverse downward moves. Holding above this area will be critical for Ethereum to avoid a deeper pullback.

If ETH manages to rebound, the first challenge lies near $4,450, followed by resistance at $4,600–$4,800. On the downside, a break below $4,200 could expose the market to further declines, potentially targeting the $3,900–$4,000 range.

BITX Analysts have pointed out the importance of ETH’s current levels. “Ethereum’s failure to sustain above $4,500 shows seller dominance in this zone. The $4,200 support is now the line in the sand for bulls.”

According to BITX “If ETH closes below $4,200 on higher timeframes, we could see momentum shift back toward bears. However, holding this level could set up a strong bounce in the coming sessions.”

For now, Ethereum’s price action highlights a critical juncture between maintaining its support or slipping into a broader correction. Traders will be watching closely whether bulls can defend the $4,200 zone, as losing this area could change the mid-term outlook for ETH.

Until ETH reclaims higher ground, caution is expected to dominate market sentiment, with eyes fixed on whether this support holds in the days ahead.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.