Traders eye key support zones as Ethereum loses bullish momentum amid broader crypto correction

Ethereum (ETH) fell sharply on Friday, touching $3,400 before stabilizing above $3,800, as the broader cryptocurrency market faced renewed selling pressure. The sudden drop, which followed a week of heightened volatility, reflects shifting investor sentiment and profit-taking near key resistance zones after Ethereum’s months-long rally.

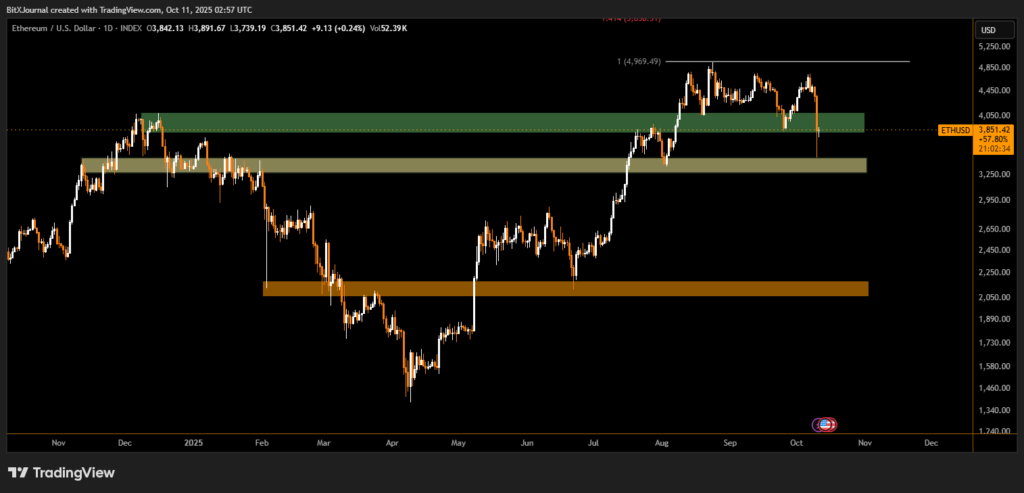

Ethereum’s daily chart shows a decisive rejection from the $4,900 resistance level, with sellers regaining control after repeated attempts to push prices higher. The decline brought ETH back into the green support region between $3,700 and $3,400, an area that has historically attracted strong buying interest.

“The market’s reaction near $3,400 will determine the next major move,” explained BITX crypto market analyst. “If buyers step in with conviction, we could see a rebound toward $4,100. But a daily close below $3,350 could trigger a deeper correction toward $3,000.”

The chart structure highlights that Ethereum’s bullish channel has weakened, and the loss of short-term momentum indicates potential consolidation before any recovery attempt.

While technicals dominate the short-term picture, experts say that macroeconomic uncertainty and declining on-chain activity have contributed to Ethereum’s pullback.

“Ethereum’s recent dip isn’t just technical,” noted BITX analyst. “Risk assets are reacting to global market stress and dollar strength. Until liquidity improves, ETH may continue to trade with a defensive bias.”

Despite the decline, Ethereum remains up more than 50% year-to-date, underscoring its resilience in a volatile environment. However, traders are closely watching whether institutional inflows and staking activity can sustain the network’s long-term momentum.

For now, $3,400 stands as a critical support level, marking the lower boundary of Ethereum’s medium-term trading range. A strong defense here could stabilize prices, but any sustained weakness may invite additional selling pressure across the altcoin market.

As volatility persists, Ethereum’s next move will likely hinge on both market sentiment and broader macro trends, making the coming week pivotal for traders.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.