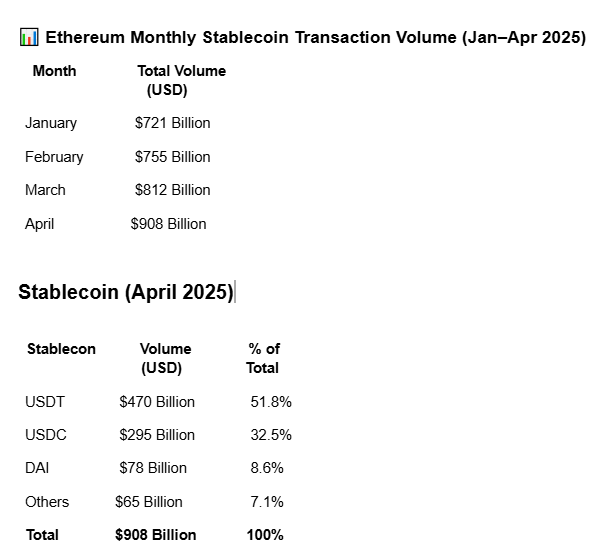

The Ethereum network has witnessed an unprecedented surge in stablecoin activity, recording $908 billion in stablecoin transaction volume in April 2025, the highest monthly total in its history. This milestone highlights Ethereum’s growing dominance as the primary settlement layer for dollar-pegged digital assets.

The data, reported by on-chain analytics firm Glassnode, confirms that Ethereum remains the undisputed leader in stablecoin infrastructure, far outpacing rival blockchains like Tron and Solana.

Surging Demand for Dollar Liquidity

The jump in volume reflects a broader trend in crypto markets: rising demand for stable, dollar-denominated assets, particularly amid global macroeconomic uncertainty. With interest rates fluctuating and inflationary fears growing in some regions, investors and users alike are increasingly turning to stablecoins for safety and efficiency.

“Stablecoins have become the default currency of the crypto economy,” said Elaine Wu, an analyst at DeFi Research Group. “Ethereum’s massive volume dominance shows it’s still the most trusted chain for serious money movement.”

Breakdown of the Volume

According to Glassnode, the bulk of the $908 billion figure was made up of three major stablecoins:

- USDT (Tether) — Over $470 billion

- USDC (USD Coin) — Approximately $295 billion

- DAI — Around $78 billion

Smaller stablecoins like FRAX, TUSD, and LUSD also contributed to the total, but to a lesser extent.

Ethereum’s large and active ecosystem of DeFi protocols, payment apps, and institutional integrations has helped boost demand for stablecoins on the network. Applications like Uniswap, Aave, and Curve Finance continue to be key drivers of stablecoin usage.

Ethereum vs. Tron and Others

Despite competition from lower-fee chains like Tron, which has seen substantial stablecoin usage (particularly USDT transfers in Asia), Ethereum remains the preferred network for high-value, transparent, and institutionally trusted transactions.

For comparison, Tron processed roughly $565 billion in stablecoin volume in April — an impressive figure but still trailing Ethereum by over 35%.

Experts say Ethereum’s edge lies in its security guarantees, liquidity depth, and mature DeFi infrastructure, which are attractive to both retail users and large crypto-native institutions.

What It Means for the Crypto Economy

Stablecoins are a critical bridge between traditional finance and crypto markets. Their increasing usage on Ethereum reflects the chain’s ongoing importance not just for trading, but also for payments, remittances, lending, and global settlements.

With Ethereum also pushing forward with Layer 2 scaling solutions such as Starknet, Arbitrum, and Optimism, stablecoin throughput is expected to grow even further in the coming months.

“Ethereum is becoming the Federal Reserve of crypto,” said Wu. “It issues, settles, and supports the majority of the world’s digital dollars.”