Despite Ethereum’s sharp drop in the wake of rising geopolitical tensions, large investors are doubling down on ETH, betting on a short-term rebound. One high-net-worth Ethereum whale made headlines by purchasing over $39 million worth of ETH on June 22, signaling strong buy-the-dip sentiment among crypto’s biggest players.

ETH Drops 12.8%, But Whales Are Buying

Ethereum’s price fell sharply, dropping 12.80% to $2,155, underperforming Bitcoin (BTC), which declined 4.70% over the same 24-hour period. The sell-off followed reports of U.S. airstrikes on Iran, which intensified concerns across global markets.

Despite the dip, blockchain data reveals that the whale wallet 0x7355…213 added 9,400 ETH in two large transactions, raising its total Ether holdings to approximately $330 million. This accumulation coincided with broader whale activity across the Ethereum network.

$263M Accumulated by Mega Whales

According to Glassnode, Ethereum addresses holding 10,000+ ETH increased their net positions significantly around June 21–22:

- 116,893 ETH (worth ~$265 million) was added during this period.

- Many of these holdings were staked via Lido’s liquid staking protocol, suggesting a long-term strategy.

“The whale is not just holding, but actively deploying capital into staking, a signal of conviction despite short-term volatility,” noted one analyst.

This accumulation during market stress hints that institutional and whale investors see long-term value, especially with the ETH ecosystem maturing through staking and L2 growth.

Bullish Setup: 25% Rebound In Sight?

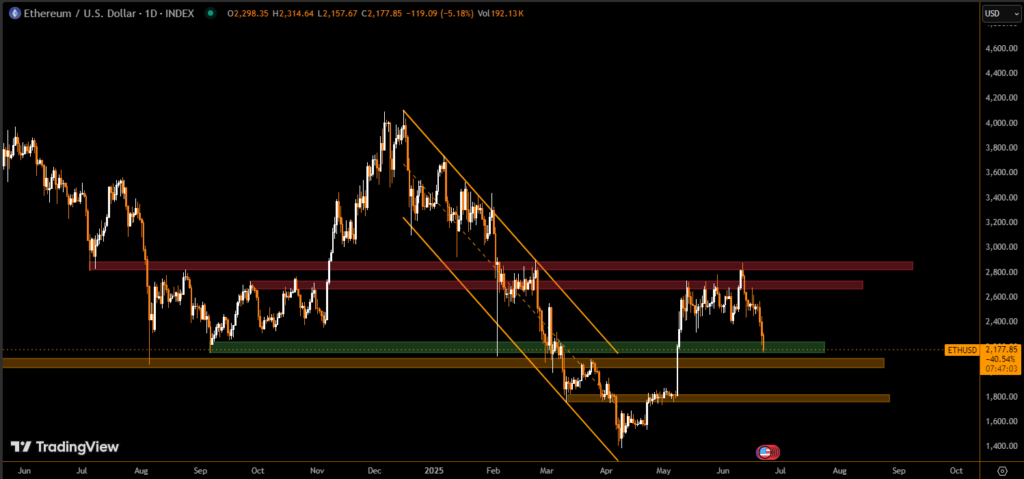

Despite the recent losses, technical indicators show Ethereum holding above an ascending trendline, supporting a potential short-term bounce:

- Market analyst Sensei suggests a recovery target near $2,735, which would represent a 25% rebound from current levels.

- The bullish outlook is further supported by reduced selling volume, a classic signal of downside exhaustion.

If market sentiment stabilizes and global tensions ease, ETH may lead the next crypto recovery wave, driven by whale confidence and strong fundamentals.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.