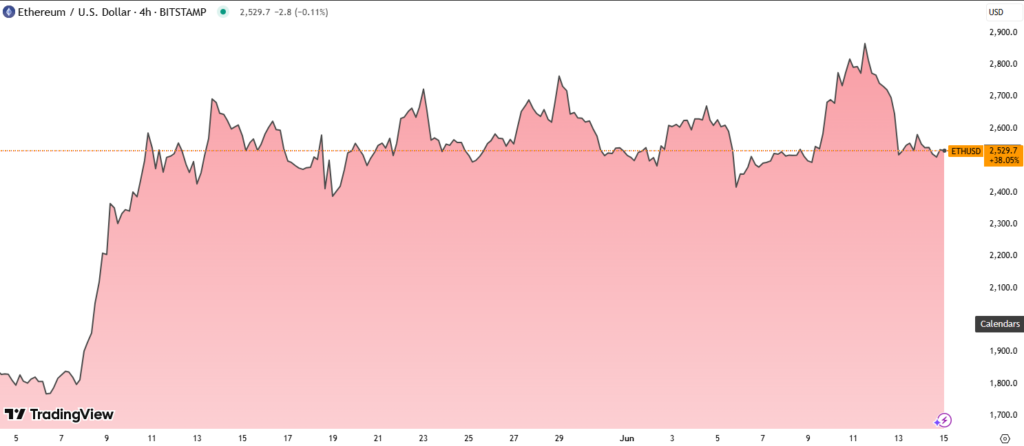

ETH holds strong above key $2,500 support zone

Ethereum (ETH) is trading at $2,508, down 0.88% in the last 24 hours, but successfully defended the psychological and technical support level at $2,500. This comes amid shifting institutional sentiment and growing divergence between retail and whale behavior.

Despite the price correction from highs near $2,870, ETH’s broader structure remains intact, supported by strong accumulation from large holders.

Whale and Shark Wallets Increase Holdings to 27%

According to on-chain data, wallets holding between 1,000 and 100,000 ETH — known as whale and shark wallets — have added a net 1.49 million ETH in the past 30 days. This increase represents a 3.72% jump in their collective holdings, now controlling 26.98% of Ethereum’s total circulating supply.

This accumulation indicates rising long-term confidence among Ethereum’s largest stakeholders, even as retail investors continue to reduce exposure amid short-term price volatility.

Retail Profit-Taking Meets ETF Outflows

While large players accumulate, retail-driven wallets have been booking profits, likely reacting to recent pullbacks and ETF news. On Friday, U.S.-listed Ethereum spot ETFs recorded $2.2 million in outflows, ending a 19-day streak of positive inflows.

This shift suggests that short-term institutional demand may be cooling, but the structural support from long-term holders could provide price stability if broader macro conditions begin to stabilize.

Technical Support Holds Near $2,500

Over the past 24 hours, ETH traded within a narrow range of $2,499 to $2,580, reflecting relative stability despite modest losses. A rebound from an intraday low of $2,454 saw Ethereum close near $2,518, backed by a surge in trading volume between 17:30–18:00 GMT.

Support is forming around the $2,500 level, which is both psychologically and technically significant. Maintaining this zone could serve as a launchpad for a potential recovery, particularly if macroeconomic and regulatory clarity improves in the near term.