Market Value Overshadowed by Ongoing Decline

Over the past 24 hours, Ethereum’s market capitalization fell to approximately $293 billion, following a 4–5% dip in its price to around $2,435 USD. This decline occurred even as global market activity remained moderate.

Trading Volume Remains High

Despite the market cap drop, Ethereum recorded a substantial $20–22 billion in 24-hour trading volume, signaling ongoing high liquidity and investor participation. Most volume was concentrated across major exchanges, reflecting sustained interest in Ether.

Price Action: Consolidation and Short-Term Selling

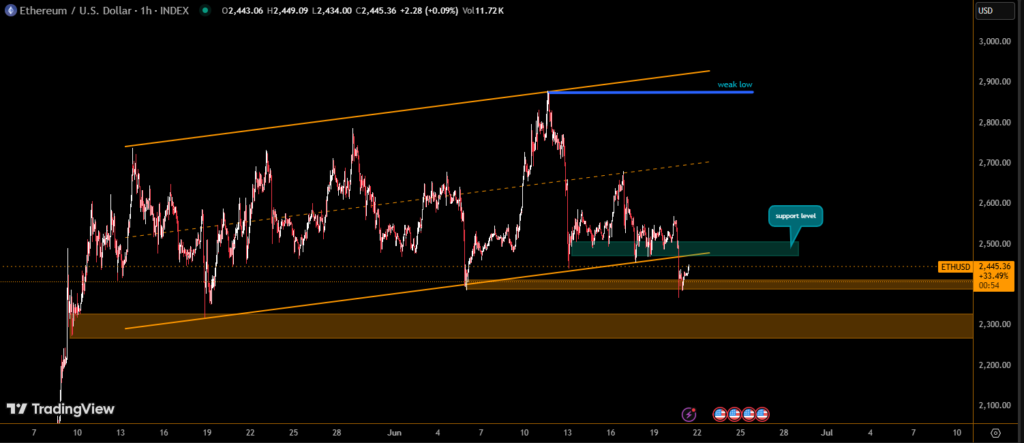

Price-wise, ETH traded within a band of $2,389 to $2,559 over the day, with a low near $2,371 and a high around $2,559. The net result was a roughly 4.5% drop, placing Ethereum below recent resistance levels and reinforcing a short-term bearish sentiment.

Market Cap Index and Crypto Dominance

Ethereum still holds the #2 position among cryptocurrencies by market capitalization, although its share of total crypto market cap has slightly declined to around 9%. Its dominance has softened amid both Bitcoin and altcoin fluctuations.

Key Technical Levels Monitoring

Support appears to have formed near $2,400, while resistance lies around $2,500. If ETH closes above $2,500 on increasing volume, the market cap could begin recovering. Conversely, dipping below $2,400 may drive further declines and drop capitalization under $290 billion.

Broader Implications for Investors

A market cap near $293 billion places Ethereum in a consolidation phase, with the next directional move hinging on key macroeconomic events and on-chain signals. Higher trading volumes suggest that price stability may return once short-term sellers exit.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.