Crypto analytics platform Santiment highlighted that the extreme negativity currently dominating social media may signal a potential market rebound. The Crypto Fear & Greed Index recorded an “Extreme Fear” score of 20 on Saturday, up slightly from 16 on Friday the lowest level in 2026 and a threshold last seen on December 19. The index had returned to “Extreme Fear” after spending most of January in the “Fear” zone.

Historical Trends Suggest Reversal Opportunities

According to Santiment, crypto markets often move opposite to crowd expectations. When sentiment is heavily bearish, it can create conditions for a rebound. The platform noted that the ratio of bearish to bullish social media comments remains heavily skewed toward fear, representing one of the few strong bullish signals available to investors.

Bitcoin and Ether Performance Amid Market Fear

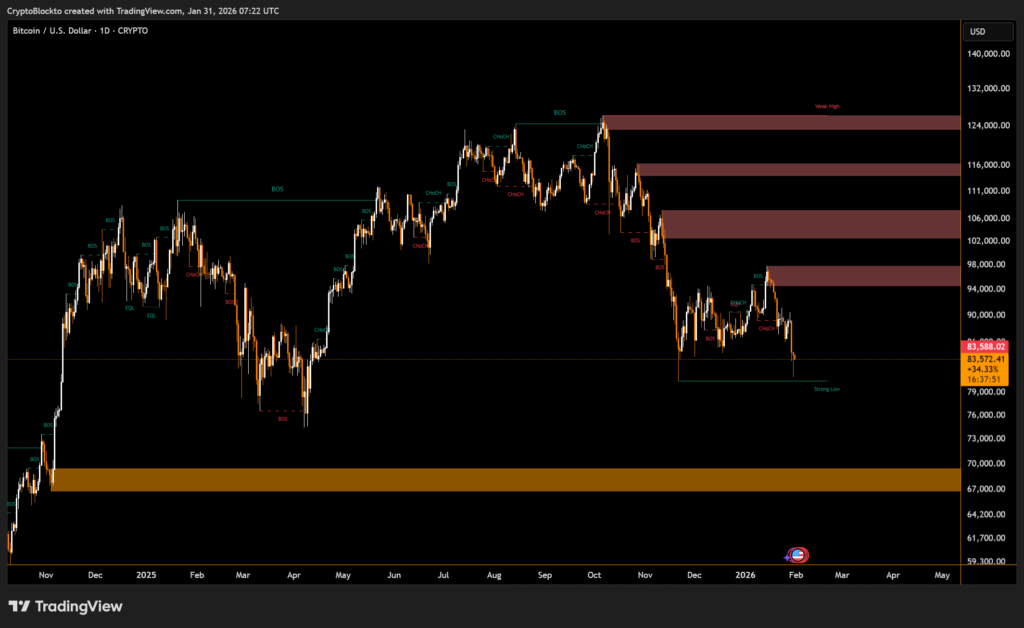

Bitcoin and Ether have declined in recent days, with Bitcoin down nearly 7% over the past week to $83,709, and Ether falling more than 9% to $2,692. Over the past 30 days, Bitcoin has lost over 4%, and neither cryptocurrency has traded above the $100,000 psychological level since mid-November, prompting some analysts to question whether the market is entering a bear phase.

Despite current market pessimism, some executives see the sentiment as temporary. Traditional financial institutions, including MasterCard, PayPal, American Express, and JPMorgan, are actively posting crypto-related jobs. This signals growing mainstream adoption and supports the view that the market’s extreme fear may be a short-term blip rather than a long-term trend.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.