The Financial Action Task Force (FATF) recently issued a warning regarding the rising risk of illicit activities using stablecoins. While some feared this could signal hostility toward the cryptocurrency sector, blockchain intelligence experts clarify that the warning is not anti-crypto, but rather a call for stronger regulatory alignment and transparency.

Stablecoins Dominate Illicit Crypto Transfers

According to blockchain analytics data, stablecoins now account for over 63% of all onchain illicit transaction volumes. This trend highlights how stablecoins have become the dominant vehicle for transacting value in crypto, both legally and illicitly.

“Stablecoins are now the primary medium in crypto crime, requiring targeted monitoring and enforcement,” said a policy expert at a blockchain analytics firm.

Despite their growing popularity, experts agree that traceability and transparency built into stablecoins make them a less effective long-term tool for criminals—especially when issuers can freeze illicit funds upon request from authorities.

FATF Calls for Supervision, Not Suppression

The FATF’s stance is not a ban but a push for regulatory maturity. It urges countries to enforce uniform licensing, implement real-time monitoring, and increase cross-border cooperation to disrupt illegal financial flows via stablecoins.

“This is about applying AML standards from traditional finance to crypto, not limiting innovation,” experts emphasized.

Advanced blockchain monitoring tools alone, however, won’t be enough. The FATF stresses the importance of secondary enforcement measures, including sanctions on entities that knowingly aid illicit transactions, especially in high-risk regions.

Circle and Tether Under Scrutiny Over Onchain Exposure

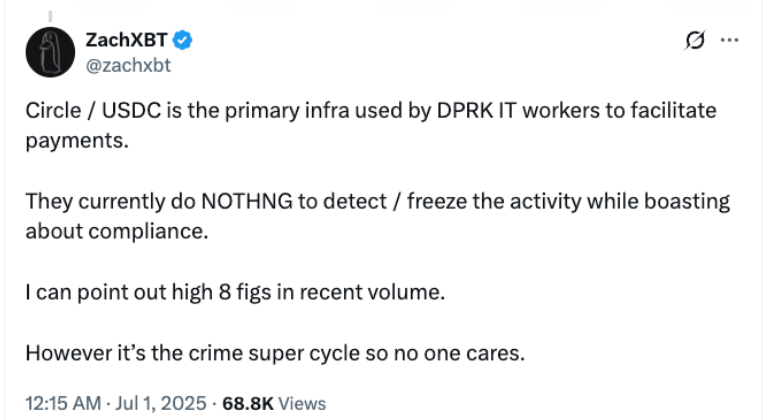

The discussion intensified after crypto analysts flagged that DPRK-affiliated IT workers are leveraging stablecoins like USDC to bypass sanctions. While Tether has frozen over $225 million in scam-related USDT, critics argue that Circle’s USDC activity lacks comparable oversight.

Crypto watchdogs point to “high eight-figure flows” in USDC allegedly linked to sanctioned actors, demanding more proactive action from issuers.

Still, stablecoins’ centralized control features give issuers the ability to freeze, block, or reverse suspicious transfers, making compliance tools available—if applied.

Stablecoin Growth Requires Responsible Oversight

The FATF’s alert is not an attack on stablecoins or DeFi—it reflects the inevitable need for safeguards as adoption grows. As regulators worldwide seek a balance between financial innovation and global security, transparent compliance and collaborative enforcement will be crucial to ensuring stablecoins support, rather than undermine, the global financial system.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.