Technical Breakout Fueled by Strong Volume and Sector-Wide Momentum

Filecoin (FIL) surged more than 70% this week, climbing above the critical $2 resistance level amid renewed strength across the DePIN (Decentralized Physical Infrastructure Networks) sector. The rally came as traders rotated into decentralized storage and data infrastructure tokens, which have shown exceptional relative strength compared to the broader crypto market.

Sector Rotation and Volume Surge Signal Renewed Investor Interest

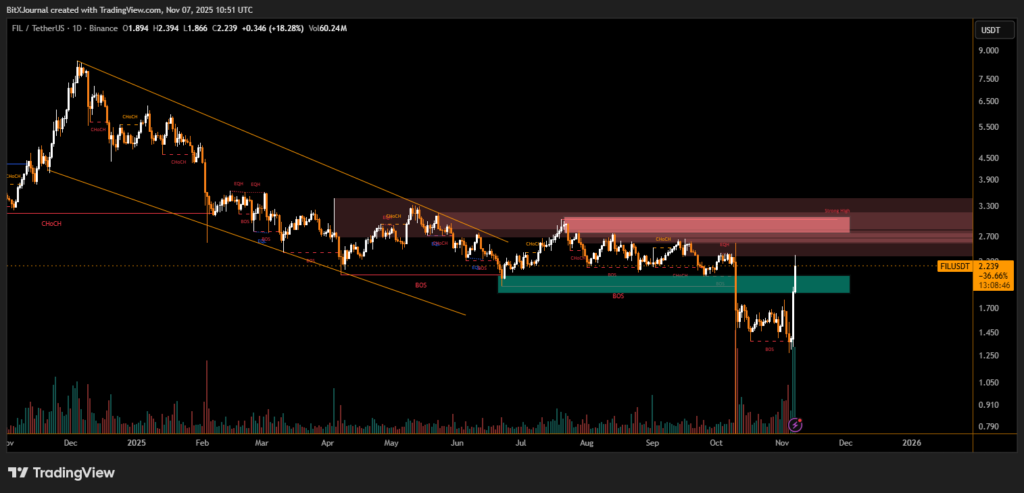

The sharp upward move was supported by a major breakout on above-average trading volume, indicating renewed institutional and retail demand. According to market observers, the breakout marks a potential end to months of consolidation within the $1.20–$1.80 range.

“Filecoin’s decisive move above $2 marks a structural shift in sentiment. The breakout on heavy volume confirms fresh accumulation and positions the asset for potential continuation toward the $2.80–$3.00 resistance zone,” BitXJournal market analyst explained.

The DePIN narrative—which focuses on blockchain-based infrastructure for real-world data, compute, and storage—has been one of the strongest-performing narratives in recent weeks. Projects like Filecoin, Arweave, and Render Network have outpaced Bitcoin and Ethereum as traders seek exposure to decentralized data infrastructure.

Technically, Filecoin has invalidated its previous bearish structure, forming a break of structure (BOS) above the $2 threshold. The breakout followed a series of higher lows and a notable change of character (ChoCH) on the daily timeframe—indicators often associated with the start of a new bullish phase.

Volume analysis shows a clear expansion in buying activity, reinforcing the breakout’s validity. If momentum sustains, analysts anticipate a move toward the $2.80–$3.40 resistance band, where significant supply remains from earlier distribution.

With the DePIN sector outperforming amid mixed market conditions, Filecoin’s resurgence highlights growing confidence in decentralized infrastructure solutions. As long as FIL maintains support above $2, the asset could continue to act as a leading indicator for broader sector strength heading into the next quarter.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.