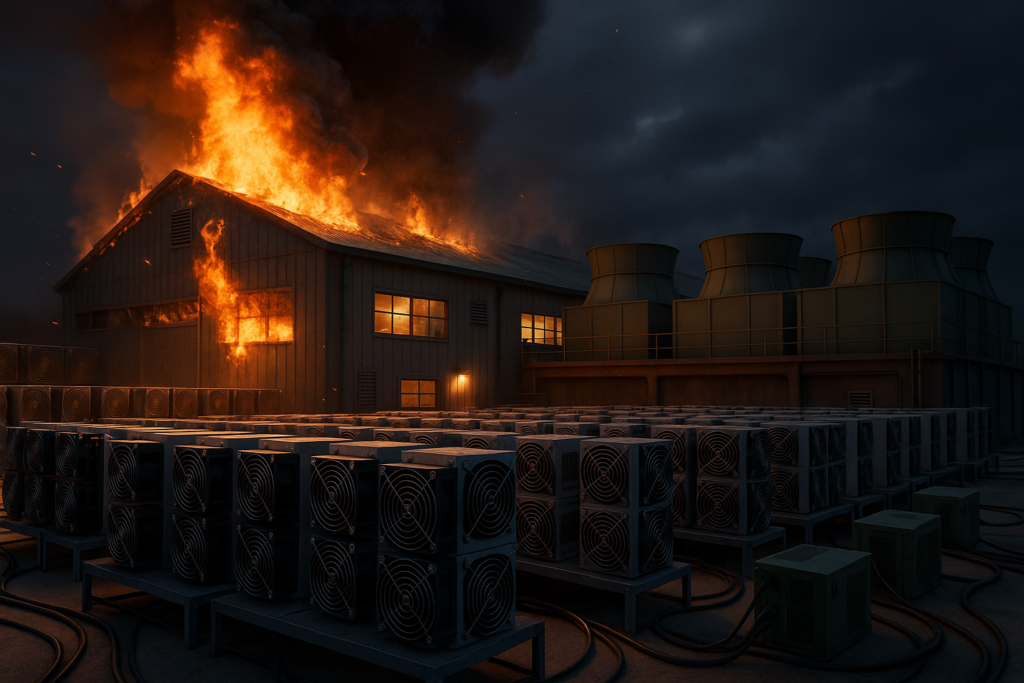

Electrical failure forces temporary shutdown, highlighting mounting pressures on Bitcoin miners

A fire triggered by an electrical switchgear failure forced Greenidge Generation Holdings to temporarily power down its Bitcoin mining facility in Dresden, New York, where it co-hosts equipment with NYDIG. According to a recent SEC filing, the entire site was de-energized for safety, though no mining hardware was damaged, and operations are expected to return within the next few weeks.

Facility Shutdown Underscores Fragility of Mining Infrastructure

The Dresden site operates a 106-megawatt natural gas-powered plant, supplying energy to Greenidge’s own machines as well as rigs co-hosted for NYDIG. The shutdown illustrates the operational vulnerabilities of large-scale mining, where firms must navigate equipment failures, costly energy inputs, supply chain delays, shrinking block rewards and regulatory constraints to stay profitable.

This incident follows similar disruptions across the industry, emphasizing how even brief outages can strain miners operating on thin margins.

Hashprice Weakness Adds Pressure to Miners

The latest setback comes as miner profitability remains under stress. Hashprice, which tracks expected revenue per petahash of computing power, dipped to around $35/PH/s in November, impacted by Bitcoin’s decline toward $80,000.

Mining becomes unprofitable near the $40/PH/s threshold, and although hashprice has recovered to about $39/PH/s, the industry remains in a fragile position.

This underscores the critical importance of stable operations, as extended downtime can push firms below profitability levels.

Industry Headwinds Intensify: Energy Costs, Shutdowns and Investigations

Rising energy costs have already forced several companies to scale back. Tether recently halted mining activities in Uruguay, citing surging electricity prices and unresolved disputes involving $4.8 million in unpaid energy fees.

At the same time, Bitmain, the dominant producer of mining hardware with roughly 80% market share, is facing a US investigation over concerns its ASIC devices could be remotely accessed for espionage. Any potential restrictions on Bitmain hardware would create yet another obstacle for miners already battling a difficult economic environment.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.