Shane Donovan Moore, a former professional rugby player, has been sentenced to 2.5 years in U.S. federal prison for running a fraudulent crypto mining operation that scammed investors out of more than $900,000.

According to the U.S. Department of Justice, Moore operated a company called Quantum Donovan LLC between January 2021 and October 2022. He convinced over 40 investors to pour funds into what he described as a lucrative cryptocurrency mining venture, promising daily returns of 1%—a classic red flag in Ponzi-style frauds.

But instead of investing in crypto mining hardware as promised, Moore diverted the money for personal use. Authorities say he used investor funds to finance a lavish lifestyle, purchasing luxury apartments, electronics, and designer goods. New investor money was used to repay earlier participants, a hallmark of Ponzi schemes.

“Mr. Moore used the newness of cryptocurrency to commit an age-old fraud — a Ponzi scheme,” said Acting U.S. Attorney Teal Luthy Miller.

https://cointelegraph.com/news/rugby-shane-moore-gets-2-5-years-for-crypto-mining-ponzi

Abuse of Trust and Athletic Fame

Federal prosecutors noted that Moore leveraged his rugby connections to attract investors, exploiting personal trust and familiarity to lend credibility to his fraudulent scheme. The betrayal hit hard—victims suffered not just financial damage, but emotional and psychological harm, as U.S. District Judge Tana Lin remarked during sentencing.

A Pattern in Crypto Fraud

Moore’s sentencing is the latest in a growing list of crypto-related Ponzi schemes that have targeted unsuspecting investors using promises of high returns and cutting-edge technology.

- In February 2024, U.S. regulators charged a man in Las Vegas who ran a $24 million AI-driven crypto mining scam.

- In late 2024, a California attorney was sentenced to probation and ordered to repay nearly $14 million from a crypto-based investment scheme.

- Earlier this year, the CFTC accused a pastor of promoting a $6 million crypto Ponzi to members of his own congregation.

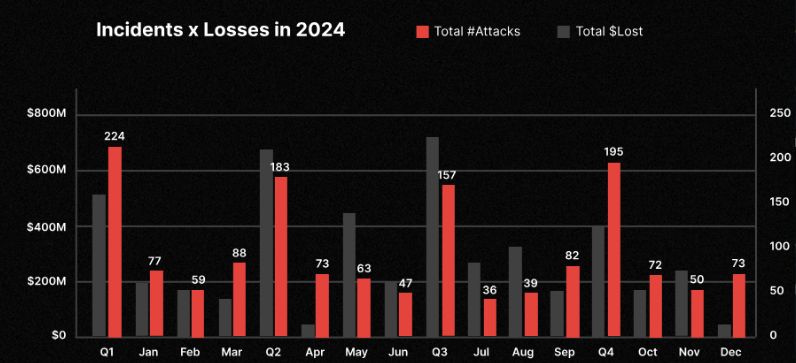

According to data from CertiK, crypto-related scams caused billions in losses in 2024 alone, highlighting the persistent risks in the sector.

Final Thoughts

As the crypto space matures, schemes like Moore’s underline the importance of investor education and regulatory vigilance. While blockchain promises transparency and decentralization, it can also be used as a tool for deception by those who exploit its complexity.

For investors: Always verify, research, and question too-good-to-be-true promises—especially in emerging technologies like crypto and AI.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.