Paris-based Blockchain Group, a rising player in the crypto investment space, has announced plans to purchase 590 more Bitcoin following the successful completion of a €63.3 million ($72 million) convertible bond issuance. This move continues the company’s aggressive Bitcoin accumulation strategy that has seen its share price soar in recent months.

Massive Investment Push to Expand Bitcoin Holdings

The company revealed on May 26, 2025, that the bond proceeds will primarily be used to expand its Bitcoin reserves to 1,437 BTC. Based on current market rates — with Bitcoin trading above $109,000 — the raised capital could purchase up to 658 BTC. However, 95% of the proceeds will be allocated to Bitcoin acquisitions, while the remaining 5% will cover operational expenses and management fees.

Leading Investors Fuel the Bond Issuance

The funding round attracted major backers, including:

- Fulgur Ventures, which contributed €55.3 million ($62.9 million)

- Moonlight Capital, investing €5 million ($5.7 million)

The issued bonds are convertible into Blockchain Group shares at a price of €3.809 ($4.34), providing investors with potential upside in both equity and crypto exposure.

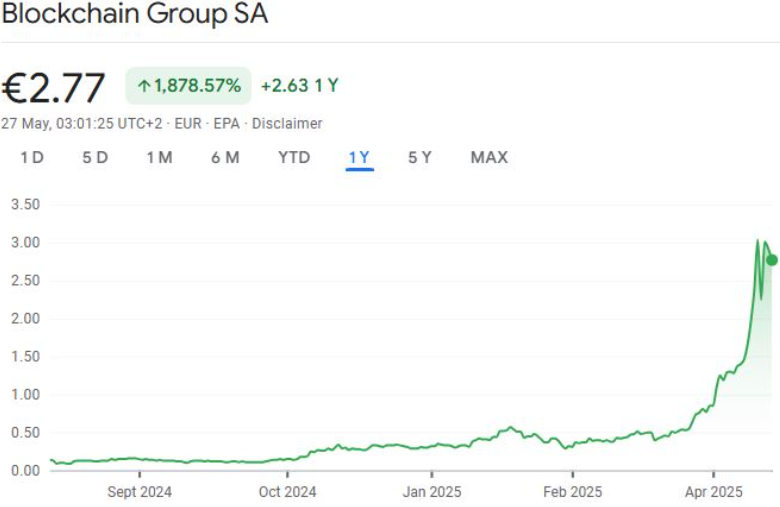

ALTBG Shares Surge Amid Bitcoin Strategy

Following the announcement, Blockchain Group (ticker: ALTBG) closed trading on Euronext Paris at €2.77 ($3.16), down 5.5% for the day. Despite the dip, the company’s stock has experienced a staggering 766% increase in 2025 alone. The rally began in November 2024, when the firm first announced Bitcoin purchases, which sent shares soaring by 225%.

Positioning as a European Bitcoin Treasury Leader

With a clear strategy of increasing Bitcoin per share and leveraging traditional financing tools for crypto exposure, Blockchain Group is emerging as Europe’s counterpart to Strategy (formerly MicroStrategy). The firm stated it will continue expanding its crypto treasury while also developing its core blockchain consulting operations.

Conclusion

As more public companies explore Bitcoin accumulation as a treasury strategy, Blockchain Group’s bold approach signals growing European interest in digital assets. With its latest bond issuance and continued acquisitions, the firm is solidifying its role as a Bitcoin-focused investment powerhouse in the EU.