Stablecoins were designed to be the safe haven of crypto — digital assets pegged to stable values like the U.S. dollar. Yet, history has repeatedly shown that even the most “stable” coins can lose their peg in seconds. From TerraUSD’s collapse in 2022 to Yala’s YU depegging in 2025, investors continue to face hidden risks behind the $1 illusion.

The Rise and Repeated Fall of Stablecoins

Despite a record $312 billion market cap as of October 2025, stablecoins still struggle with trust, liquidity, and transparency. The crypto market has seen numerous failures — from NuBits in 2018 to USDC’s 2023 bank-linked depeg — proving that both algorithmic and fiat-backed models face vulnerabilities.

When TerraUSD (UST) collapsed in May 2022, it erased nearly $50 billion from the crypto market, marking one of the biggest financial implosions in blockchain history. In 2025, Yala’s Bitcoin-backed YU became the latest example, losing its peg after a cross-chain exploit exposed weak liquidity pools and poor defense mechanisms.

Stablecoins are nearing mainstream scale, but stability remains an illusion when liquidity, design flaws, and market trust break down.

Case Study 1: The 2022 TerraUSD Collapse

TerraUSD (UST) aimed to maintain a $1 peg using an algorithmic mint-burn system with its sister token LUNA. The model was fueled by Anchor Protocol’s unsustainable 20% interest rates, which attracted billions in deposits.

When confidence faded and whales began withdrawing funds in May 2022, LUNA’s supply ballooned from 1 billion to nearly 6 trillion tokens in just days, sending its price to zero. UST followed, crashing to a few cents.

The result? A market-wide domino effect that triggered liquidations, exchange losses, and devastated investor confidence in algorithmic stablecoins.

Terra’s collapse proved that algorithmic stability breaks under pressure — especially when built on fragile incentives and thin liquidity.

Case Study 2: Yala’s YU Depegging in 2025

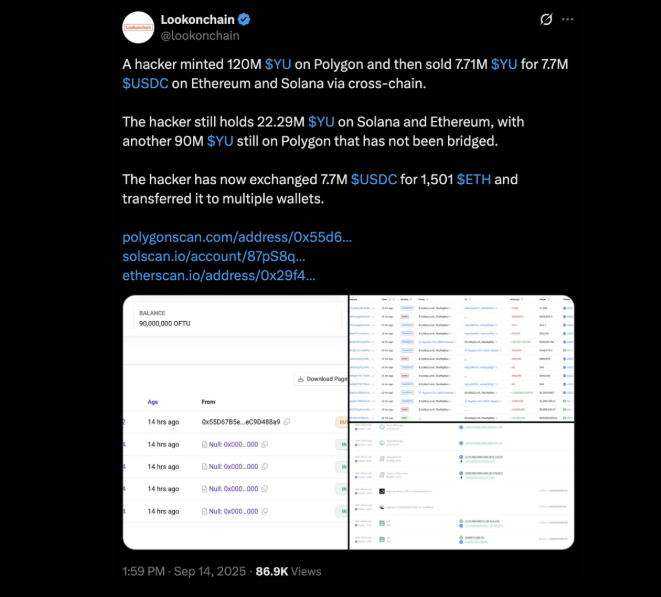

In September 2025, Yala’s Bitcoin-backed stablecoin (YU) lost its $1 peg after an exploit minted 120 million unauthorized tokens on the Polygon network. The attacker converted 7.7 million YU into 7.7 million USDC and later into 1,501 ETH, spreading funds across Ethereum and Solana wallets.

Although Yala confirmed that all Bitcoin collateral remained safe, YU failed to recover immediately due to extremely low on-chain liquidity. By September 18, YU finally regained its peg, but the event exposed the risks of cross-chain vulnerabilities and overreliance on bridge mechanisms.

Thin liquidity and cross-chain exposure can turn minor exploits into full-blown crises for stablecoins.

Why Stablecoins Lose Their Peg

- Liquidity Shortages:

Low liquidity pools amplify price volatility. Large redemptions or sell-offs can drag stablecoins below $1 — as seen in Terra’s Curve pool imbalance and Yala’s small Ether pool. - Loss of Trust and Market Runs:

Fear spreads faster than code. Once confidence breaks, users rush to redeem, creating a crypto-style bank run. - Algorithmic Design Flaws:

Mechanisms like mint-burn work only in calm markets. In stress, supply expansion kills price support — exactly what doomed TerraUSD. - External Shocks:

Bank failures, hacks, or macro crises (like SVB’s collapse in 2023) can instantly undermine even fiat-backed stablecoins.

Most depegs begin with low liquidity — but end with panic and systemic loss of confidence.

Risks Investors Can’t Ignore

- Financial Losses: Depegs cause permanent capital erosion, especially for users holding coins during collapse.

- Security Flaws: Exploits can mint fake tokens or drain liquidity pools, leaving holders stranded.

- Regulatory Scrutiny: With stablecoins nearing $300 billion in circulation, governments are demanding proof-of-reserves and licensing compliance.

- Systemic Ripple Effects: One failure — like Terra’s — can cripple DeFi protocols, exchanges, and lending markets linked to it.

Preventing the Next Collapse

Future stability depends on stronger collateral models and full transparency.

Projects are adopting over-collateralization, real-time audits, and proof-of-reserves to rebuild trust. Integrating insurance funds, multi-signature control, and compliance with MiCA and U.S. stablecoin laws are now critical for survival.

The lesson is clear: stability isn’t achieved through code alone — it requires liquidity, transparency, and accountability.

In summary, the failures of TerraUSD, USDC, and Yala’s YU highlight one truth — no stablecoin is truly stable without deep liquidity, real collateral, and transparent risk management. As adoption grows, investors must remember: “$1” is just a promise — and in crypto, promises can break overnight.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.