Steve Kurz, global head of asset management at Galaxy Digital, believes the recent crypto selloff reflects a healthy market reset rather than structural failure. According to Kurz, the downturn was largely driven by liquidity tightening and leverage unwinds, distinguishing it from the systemic breakdowns seen in 2022.

He argues that most forced selling has likely already occurred, reducing the probability of another sharp leg lower. Instead of a rapid V-shaped rebound, Kurz expects several months of consolidation followed by gradual upside as broader liquidity conditions stabilize.

Institutional Adoption and Blockchain Infrastructure Growth

At the center of Galaxy’s 2026 outlook is what Kurz calls the “great convergence” — the integration of crypto infrastructure with traditional financial systems. The firm, founded by Michael Novogratz in 2018, now oversees roughly $12 billion in platform assets.

Stablecoins, tokenization and blockchain-based financial rails are expanding across banks and fintech platforms, reinforcing crypto’s dual role as both an asset class and institutional-grade infrastructure. Kurz notes that while token prices have softened, underlying business activity remains resilient.

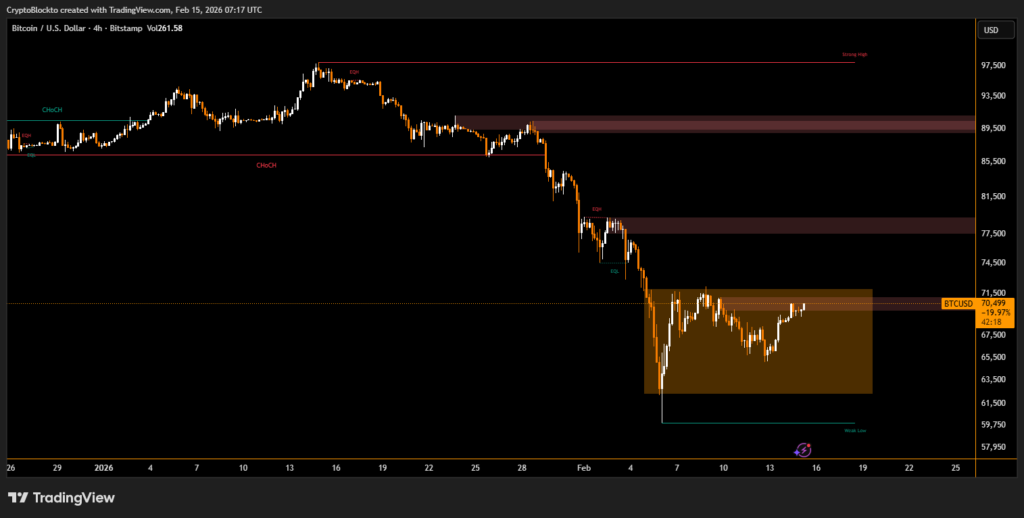

Bitcoin’s Role in Macro Risk Cycles

Bitcoin, trading near $70,000, increasingly moves within broader macro and liquidity cycles. Kurz describes it as a “canary in the coal mine,” often reacting early to shifts in global risk appetite.

While sentiment remains cautious, Galaxy sees steady engagement from pensions, sovereign funds and wealth managers. The firm’s strategy focuses on capturing opportunities across asset management, fintech and infrastructure, positioning itself at the center of crypto’s structural evolution.

For 2026, the message is measured but constructive: consolidation now, deeper institutional integration ahead, and long-term gains driven by infrastructure maturity rather than speculation alone.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.