Galaxy is preparing to launch a $100 million hedge fund designed to profit from both rising and falling cryptocurrency prices, signaling a strategic shift as the market moves beyond its prolonged bullish phase. The fund is expected to debut in the first quarter, reflecting growing demand for more flexible investment approaches in digital assets.

The new hedge fund will deploy a long-short strategy, taking positions across crypto tokens and traditional financial equities connected to blockchain infrastructure. Up to 30% of the capital will be invested directly in cryptocurrencies, while the remaining funds will target financial services stocks influenced by regulation, blockchain adoption, and technological change.

The strategy has already attracted $100 million in commitments from family offices, high-net-worth individuals, and select institutional investors. Galaxy will also make a seed investment, though the amount has not been disclosed.

According to the fund’s leadership, the crypto market is transitioning away from an “up-only” cycle. While maintaining a constructive outlook on major assets such as Bitcoin, Ethereum, and Solana, the fund plans to capitalize on volatility rather than relying solely on price appreciation.

Bitcoin remains relevant, particularly in an environment shaped by potential interest rate cuts, provided broader markets such as equities and gold remain stable.

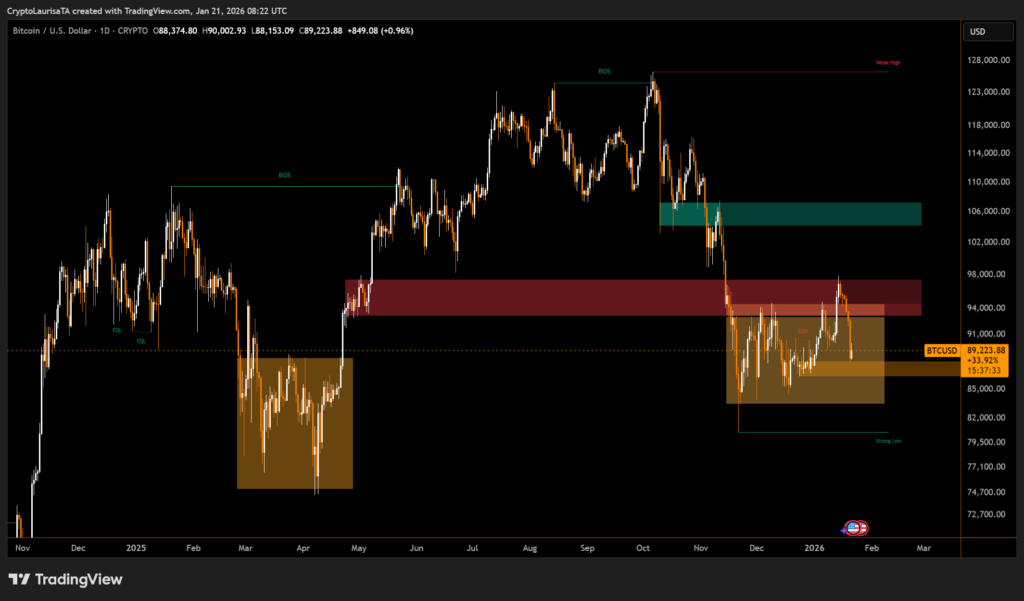

In addition to digital assets, the fund is closely watching traditional payments and data companies, where shifting regulations and advances in blockchain and artificial intelligence are reshaping valuations. The move comes as Bitcoin trades near $90,000, following a 30% pullback from its October peak, underscoring the importance of adaptive investment strategies in today’s market.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.