Blockchain Sleuth Exposes Alleged Crypto Laundering

In a major revelation shaking the DeFi community, blockchain investigator ZachXBT has accused Garden Finance, a Bitcoin bridge protocol, of being deeply entangled in laundering stolen funds — specifically, those linked to the infamous Bybit hack and North Korean Lazarus Group.

“Over 80% of your fees came from Chinese launderers moving Lazarus Group funds,” ZachXBT posted on June 21, directly calling out the platform’s co-founder Jaz Gulati.

What is Garden Finance?

Garden Finance presents itself as the “fastest Bitcoin bridge”, boasting:

- 24,984 BTC bridged (over $1.5 billion in volume)

- 40,571 atomic swaps

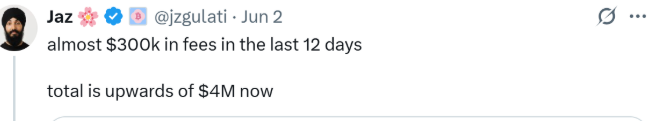

- 40.11 BTC in collected fees, with $300,000 earned in just 12 days ending June 2

- Claims of zero-custody risk and trustless swaps within 30 seconds

But these numbers are now being questioned due to alleged centralized liquidity activity and illicit transactions.

Decentralization Claims Under Fire

ZachXBT challenged the platform’s decentralization narrative, stating he observed a single entity repeatedly topping up cbBTC liquidity from Coinbase. This pattern implies centralized intervention — undermining Garden’s claim of being trustless.

“Explain how it is ‘decentralized’,” ZachXBT wrote, suggesting manipulation in real-time liquidity movements.

Founder Denies Accusations

In response, Gulati defended Garden Finance, emphasizing that 30 BTC in fees were collected before the Bybit incident. He also dismissed the claims as “misinformation”, labeling the accusations as part of an effort to discredit the platform.

Industry Crackdown on Crypto Laundering

This controversy follows broader law enforcement actions against crypto-enabled laundering:

- $530 million laundering case: Evita Pay’s founder, Iurii Gugnin, was recently arrested in New York for helping sanctioned Russian banks access U.S. tech through crypto transactions.

- Hong Kong authorities are developing crypto tracing tools to fight money laundering more effectively.

Conclusion

The allegations against Garden Finance spotlight growing concerns over transparency, decentralization, and regulatory oversight in the cross-chain infrastructure space. If proven, the case could signal intensified scrutiny from global watchdogs as illicit flows continue to exploit decentralized finance rails.

The crypto community awaits further clarity as investigators and regulators weigh in on the evolving situation.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.