Gemini’s decision to withdraw from the United Kingdom has reignited debate over whether the country’s regulatory approach is discouraging crypto firms rather than attracting them. The exchange has chosen to narrow its international footprint, prioritizing the United States and Singapore while exiting the UK, European Union, and Australia.

UK Crypto Regulation Challenges

The UK government has repeatedly stated its ambition to position the country as a global center for crypto innovation. That vision included plans for stablecoin regulation and closer engagement between regulators and industry. However, progress has been slow, leaving firms operating under interim rules, overlapping compliance obligations, and uncertainty around future requirements.

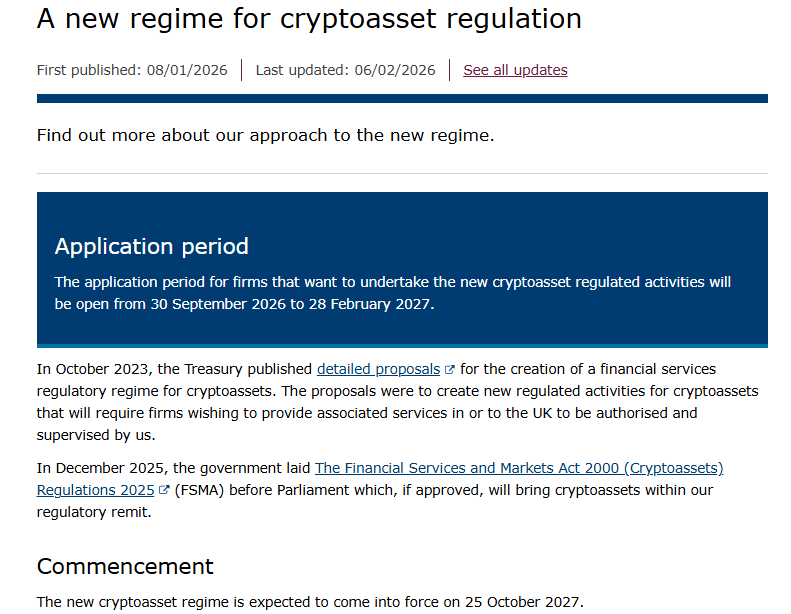

Crypto businesses currently face a mix of anti-money laundering registration, strict financial promotions rules, and evolving guidance, while the full regulatory framework remains several years away. For many firms, the cost of complying with these transitional regimes outweighs the commercial opportunity offered by the UK market.

Compliance Costs and Market Friction

Under proposed rules, crypto companies serving UK users will need to apply for full authorization within a limited gateway window ahead of a new prudential regime expected to take effect in 2027. Industry groups warn that unresolved issues, particularly around stablecoins and systemic oversight, could create operational risks and prompt further exits.

Regulators continue to consult on capital, liquidity, and operational standards, signaling a clear direction toward tighter oversight. While some firms may commit to meeting these standards, Gemini’s departure highlights the risk that regulatory uncertainty could undermine the UK’s crypto hub ambitions.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.