Gemini, the US-based cryptocurrency exchange founded in 2015, has announced its withdrawal from the United Kingdom, European Union and Australia, alongside a 25% reduction in its global workforce. The company said the decision reflects both changing technology dynamics and challenging operating conditions in overseas markets.

Workforce Cuts Driven by AI and Market Pressures

According to the company, advances in artificial intelligence have significantly reduced the need for large engineering teams, with automation dramatically improving productivity. Combined with regulatory complexity, higher costs and weaker user demand in the UK, EU and Australia, these factors made continued expansion in those regions difficult to justify.

Gemini stated that managing multiple international jurisdictions added operational strain and slowed execution, prompting a strategic pullback to concentrate resources more effectively.

Focus Shifts to US and Prediction Markets

Going forward, Gemini plans to prioritize growth in the United States, citing deep capital markets and stronger demand. A key part of this strategy is the expansion of its prediction market platform, Gemini Predictions, launched in December 2025.

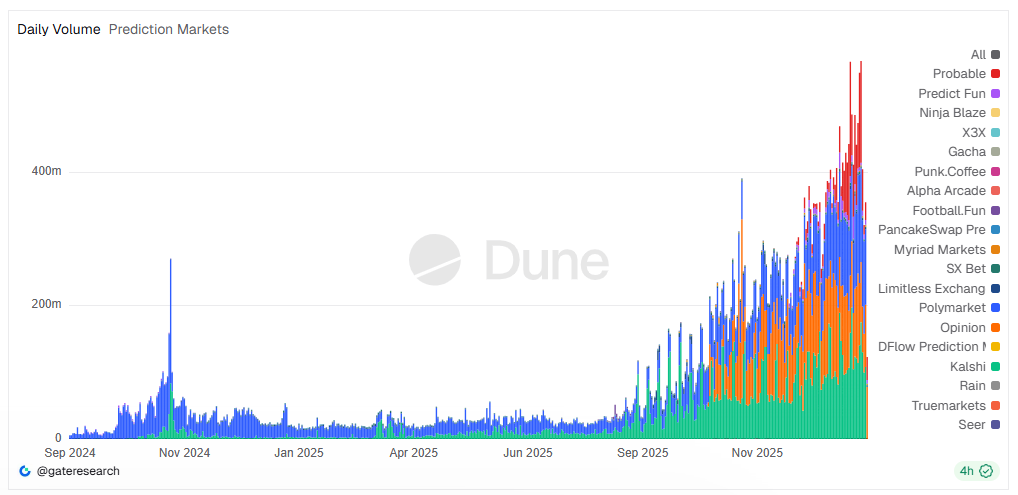

The platform has already attracted more than 10,000 users and generated approximately $24 million in trading volume. Prediction markets have seen rapid growth globally, with volumes surging during major political events and continuing into 2026.

The move comes amid a broader downturn in crypto markets, following sharp price declines and regulatory uncertainty, reinforcing a trend of firms consolidating around core, more profitable regions.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.