Gold and silver prices climbed to fresh record highs as investors sought safety amid rising geopolitical and trade tensions. While precious metals strengthened, equity markets across Europe moved lower, reflecting growing concern over global economic stability and trade policy uncertainty.

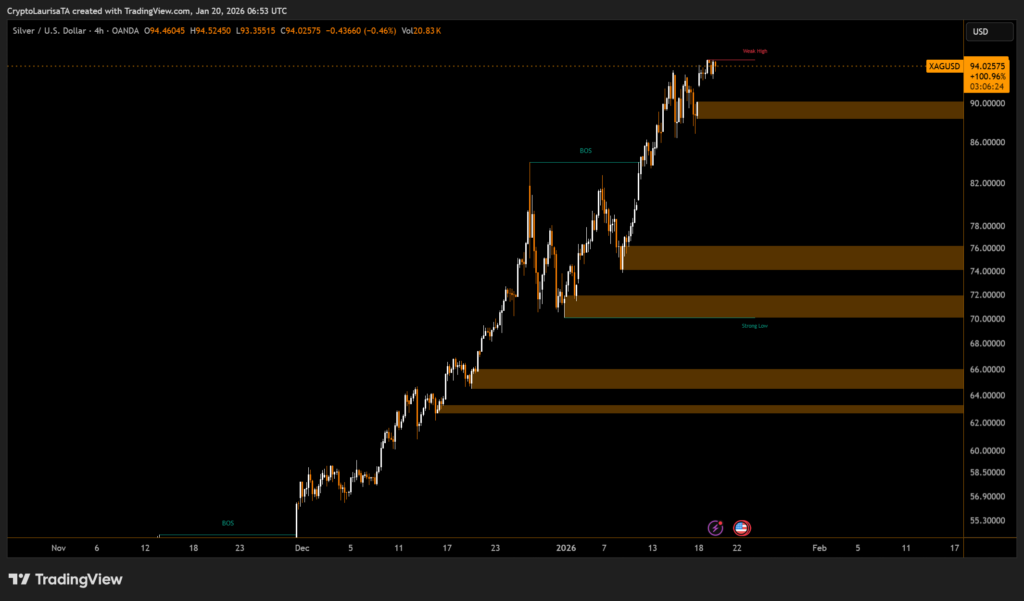

Gold prices touched $4,714 per ounce, while silver briefly surged to $94.08 per ounce, underscoring the strong appetite for assets traditionally viewed as stores of value. Precious metals tend to outperform during periods of political risk, inflation concerns, and market volatility, and recent developments have reinforced that trend.

Over the past year, gold has gained more than 60%, supported by expectations of interest rate cuts, sustained central bank purchases, and heightened geopolitical friction. Silver has also benefited, aided by supply concerns following export restrictions from China.

Despite the metals rally, European share prices declined sharply. Major indices fell as investors reacted to renewed trade tensions between the United States and Europe. Concerns over potential retaliatory tariffs have weighed heavily on sentiment, particularly in the automotive, technology, and luxury goods sectors.

As long as geopolitical risks and trade uncertainty persist, gold and silver are likely to remain well supported. In contrast, equity markets may continue to face pressure until clearer signals emerge on global trade policy and economic direction.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.