Gold Market Outlook: Price Correction Deepens After Record Rally

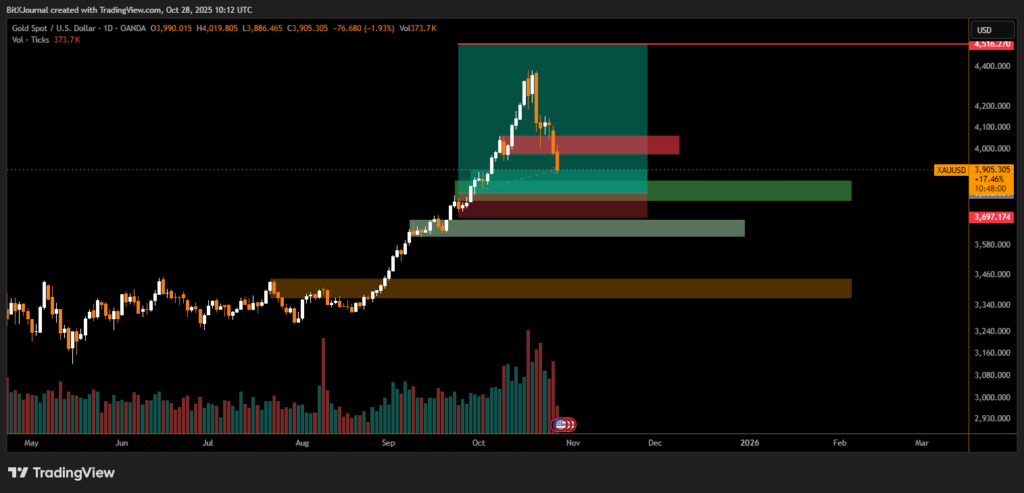

Gold prices dropped below the $3,900 mark on Tuesday, signaling a notable shift in momentum after weeks of strong bullish performance. The metal, trading around $3,905 per ounce, has lost nearly 1.9% intraday, as traders took profits following a steep rally that pushed prices toward the $4,020 resistance zone.

Technical indicators suggest that XAU/USD may be entering a short-term correction phase, with key support levels now forming between $3,700 and $3,680. Analysts note that the current retracement follows a sharp vertical move that began in mid-August, when gold broke above major resistance zones near $3,500.

Technical Analysis: Demand Zone at $3,700 Could Trigger Bounce

The daily chart shows a clear retracement within an ascending structure, with prices testing the 38.2% Fibonacci retracement level from the recent uptrend. The volume profile also indicates strong buying activity in the $3,700–$3,680 range, suggesting that this zone could act as the next demand base if selling pressure continues.

A break below this zone may open the door to further declines toward $3,380, where a major institutional support cluster remains. On the upside, resistance is seen at $4,020, followed by the all-time high near $4,516.

BitXJournal Market strategist commented that, “After such an aggressive rally, a corrective wave was inevitable. What’s important now is whether gold finds stability above $3,700 — that will decide if the bullish structure remains intact.”

Momentum oscillators such as RSI have cooled from overbought conditions, aligning with the ongoing pullback. However, the broader trend remains bullish as long as gold holds above $3,680. Traders are now looking for a bullish rejection candle or higher-low formation to confirm renewed buying interest.

“This correction could offer a fresh accumulation opportunity if the $3,700 area holds,” noted a senior commodity analyst.

In conclusion, the drop below $3,900 marks a critical short-term test for gold’s strength. The market’s reaction around the $3,700 support will determine whether the metal resumes its climb toward new highs or enters a deeper consolidation phase.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.