Precious metal breaks out amid global uncertainty and renewed investor demand for safe-haven assets

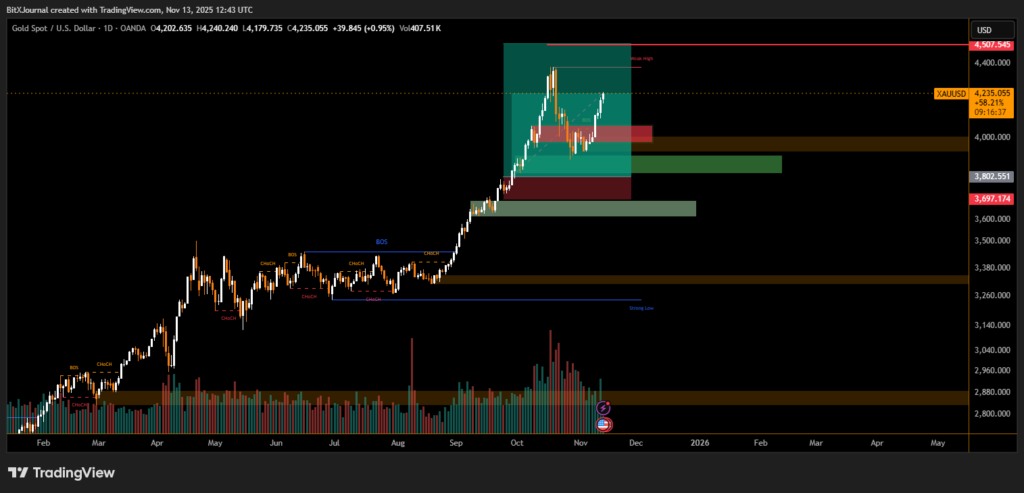

Gold prices surged above $4,230 per ounce, marking one of the strongest rallies of 2025 as investors sought stability amid continued economic and geopolitical uncertainty. The spot gold (XAU/USD) chart shows a clear bullish continuation pattern, supported by higher trading volumes and a decisive breakout above the $4,000 psychological resistance level.

According to recent trading data, gold has gained nearly 60% year-to-date, supported by rising central bank purchases, weakening global bond yields, and increased safe-haven flows. The latest breakout aligns with a broader bullish structure that began forming in mid-2024, when gold consolidated below $3,800 before staging a sharp upward reversal.

“The market has entered a new price discovery phase,” said BitXJournal senior commodities strategist. “A sustained close above $4,200 could open the path toward the next resistance zone near $4,500, which aligns with long-term Fibonacci extensions and prior liquidity clusters.”

The technical structure highlights a break of structure (BOS) followed by multiple change of character (ChoCH) signals, confirming a strong bullish trend. The key demand zones are now observed between $3,800 and $3,700, where institutional orders are likely positioned. Analysts note that maintaining support above these levels will be crucial for extending the rally into early 2026.

BitXJournal analyst commented, “The volume profile suggests accumulation rather than distribution, which supports the case for continuation. If inflation data remains elevated and monetary easing persists, gold could challenge new all-time highs before mid-2026.”

Market watchers also point to a noticeable increase in retail participation and ETF inflows, indicating that gold’s momentum is being fueled by both institutional and speculative demand.

As of Thursday’s session, spot gold trades around $4,231, consolidating just below its recent highs. The next few weeks may prove pivotal as traders evaluate whether this breakout marks the beginning of a new long-term bull cycle or a temporary overextension in an overheated market.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.