Gold’s meteoric rise over the last 24 hours has added $1.65 trillion to its market capitalization, nearly matching Bitcoin’s $1.75 trillion total market value. The rally highlights a growing divergence between investor sentiment in precious metals and cryptocurrencies.

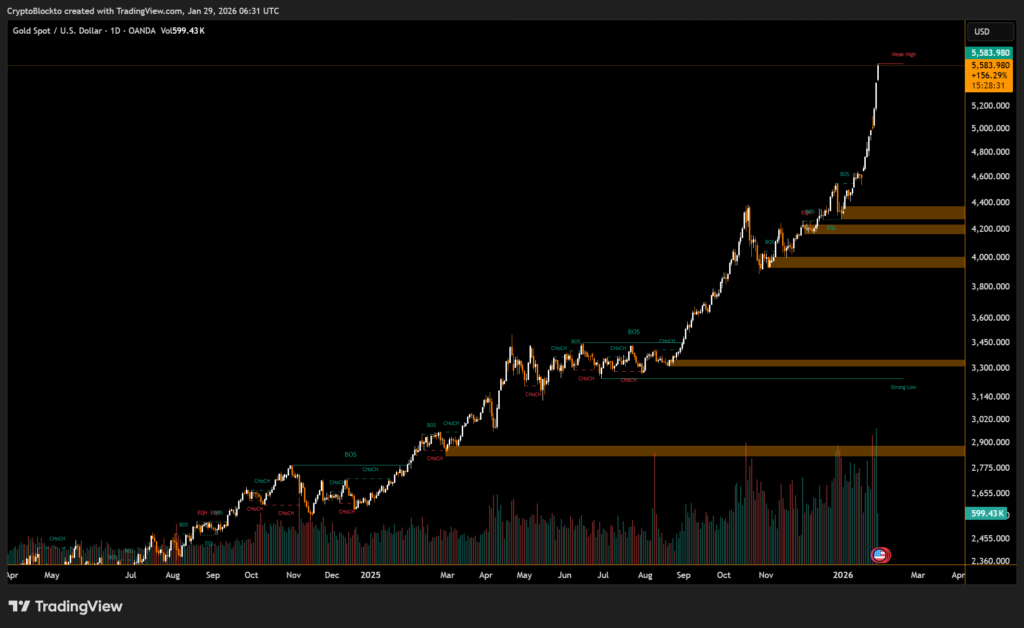

Gold Hits New Record Levels

Gold breached $5,500 per ounce, bringing its total market cap to $38.77 trillion, while silver also gained 21.5% over the past week, reaching $6.6 trillion. Analysts attribute the multi-month precious metals rally to the ongoing “debasement trade”, as investors seek safe havens amid monetary expansion and fiscal uncertainty.

Bitcoin vs. Gold Performance

Over the past five years, gold has outpaced Bitcoin, rising 173% compared to Bitcoin’s 164% gain. Bitcoin’s price has struggled to recover since the October 2025 crypto market crash, which saw over $19 billion in liquidations. Despite this, institutional confidence remains high, with 71% of investors surveyed viewing Bitcoin as undervalued between $85,000 and $95,000.

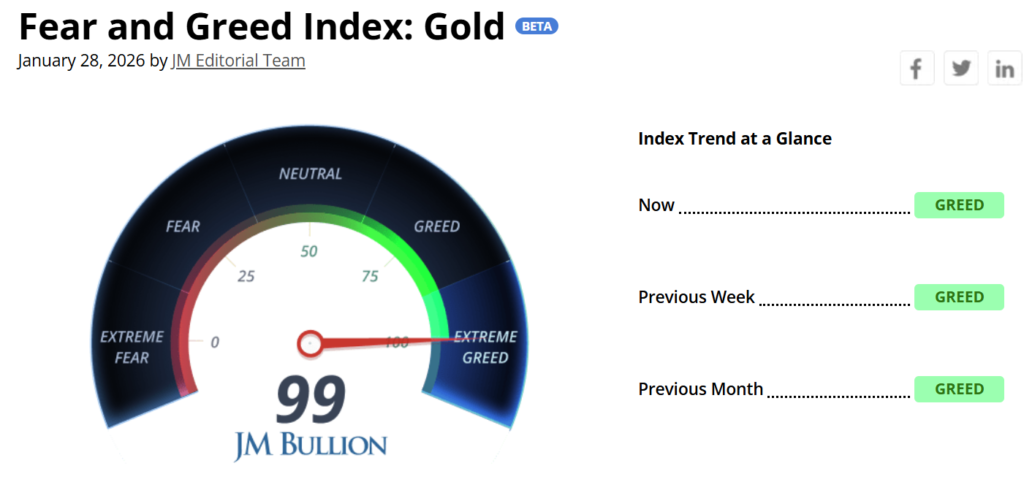

Investor Sentiment Divergence

The Crypto Fear & Greed Index currently reads 26 out of 100, signaling fear in the Bitcoin market. In contrast, gold’s Fear & Greed Index is 99, showing extreme greed. The data underscores a stark contrast in how investors approach precious metals and cryptocurrencies in the current economic environment.

Gold’s rapid market cap surge emphasizes its role as a dominant safe-haven asset, while Bitcoin faces short-term volatility despite long-term institutional optimism.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.