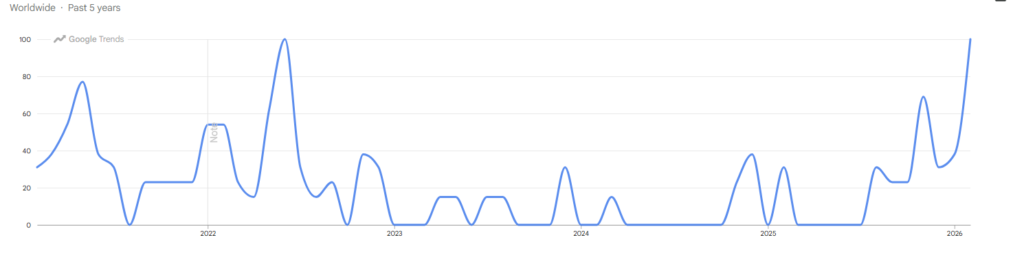

Global searches for the phrase “Bitcoin going to zero” have climbed to their highest level since November 2022, when the collapse of FTX triggered widespread panic across digital asset markets. The renewed spike in search activity comes as Bitcoin trades near $66,500, down nearly 50% from its October 2025 all-time high of around $126,000.

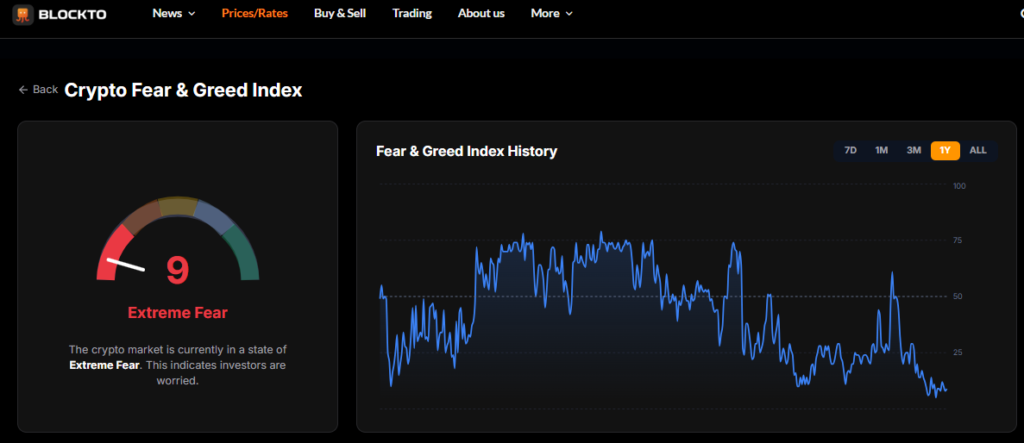

Market sentiment indicators reflect similar anxiety. The crypto Fear and Greed Index has dropped into extreme fear territory near 9, levels last seen during the 2022 crypto contagion that followed major exchange and lender failures.

Institutional Accumulation Contrasts Retail Fear

Despite rising retail concern, institutional behavior appears more measured. Large asset managers and sovereign investors continue to accumulate exposure through exchange traded products and corporate treasury allocations. Analysts note that media sentiment surrounding Bitcoin began stabilizing earlier this month, even as Google search interest in catastrophic outcomes accelerated.

The divergence suggests that retail reactions may lag professional market positioning by several days. Unlike 2022, when industry specific failures drove panic, current fears are tied more closely to macroeconomic uncertainty and high-profile bearish commentary.

With global uncertainty indicators at record highs, Bitcoin’s volatility remains intertwined with broader financial market stress rather than isolated crypto events alone.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.