Blockchain Analysts Warn of Growing Risk, Fund Flows Continue Unchecked

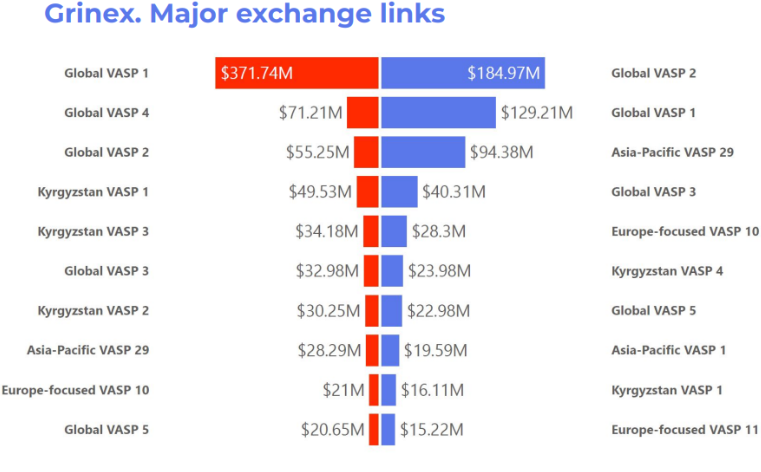

Grinex, the suspected successor to the sanctioned Russian crypto exchange Garantex, has reportedly moved over $1.66 billion through cryptocurrency exchanges, despite repeated warnings from blockchain analysis firms. The exposure to Grinex-linked wallets continues to increase, raising alarm bells across the compliance and digital asset security sectors.

Grinex emerged following the March shutdown of Garantex by U.S., German, and Finnish authorities. Since then, the Swiss analytics firm Global Ledger has monitored a sharp rise in transactional activity tied to Grinex.

Explosive Growth in Exposure Raises Compliance Concerns

Initially, Global Ledger estimated $1 billion in exposure across crypto exchanges as of early May. However, that number has now climbed to $1.66 billion as of May 30, according to updated findings. These transactions span 180 different virtual asset service providers (VASPs), indicating widespread engagement despite red flags.

“The amount is devastating and growing daily,” said Yury Serov, Head of Investigations at Global Ledger.

USDt on Tron Network Dominates Suspected Illicit Activity

Most of the Grinex fund flows involve Tron-based USDt (Tether). According to Bitrace, a blockchain compliance company, over 70% of all potentially illicit stablecoin transactions in 2024 occurred on the Tron network.

In total, Bitrace tracked $649 billion in stablecoin flows linked to high-risk addresses this year alone.

As of May 30, Tron has surpassed Ethereum in total USDt supply, making it the primary channel for these high-risk transactions. Grinex-related wallets are playing a key role in these movements, further complicating the compliance landscape for crypto exchanges.

Exchanges Notified, But Response Remains Mixed

Global Ledger confirmed that several exchanges were notified about suspicious Grinex-related fund flows. While some acknowledged the alerts, others have not responded to the compliance outreach.

“Some exchanges have acknowledged what we provided; others remain silent,” Serov noted.

Under the FATF’s Travel Rule, receiving VASPs are required to collect identifying information about the sending party. The lack of consistent enforcement suggests major gaps in compliance practices across the global crypto ecosystem.

Conclusion

As Grinex continues to process billions despite its Garantex connection, the case highlights serious enforcement challenges in the digital asset industry. Without stronger regulatory oversight and inter-exchange cooperation, high-risk platforms could continue exploiting gaps in the system unchecked.