Crypto market maker GSR has joined forces with regulated tokenized asset exchange DigiFT to introduce secondary over-the-counter (OTC) trading for tokenized real-world assets (RWAs). The initiative allows accredited institutions to trade tokenized units of leading funds — including Invesco’s iSNR, UBS’s uMINT, and Wellington’s ULTRA — during Asian market hours.

The collaboration aims to solve a long-standing issue in the RWA sector: delayed net asset values. By providing live secondary pricing, the platform will give institutional investors greater flexibility and more accurate market data for trading decisions.

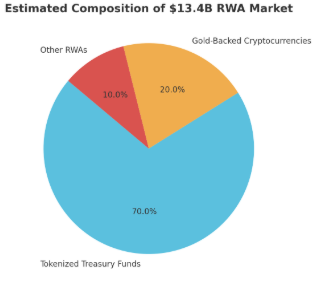

The launch comes as the tokenized real-world asset market reaches $13.4 billion, according to data from DeFiLlama. The majority of these assets are tokenized treasury funds and gold-backed cryptocurrencies, reflecting a growing institutional appetite for blockchain-based investment vehicles.

Tokenized RWAs have emerged as one of the fastest-growing segments in the digital asset space, offering regulated, on-chain exposure to traditional financial instruments. The combination of compliance-focused exchanges like DigiFT and liquidity providers like GSR is seen as a critical step toward scaling adoption.

By aligning trading hours with the Asian market, the collaboration bridges a liquidity gap that often leaves institutions in the region waiting for Western markets to open. This could make RWAs more attractive to Asia-based funds, family offices, and corporate treasuries seeking diversified yield opportunities.

With secondary OTC trading now available, industry analysts believe that greater price transparency, improved liquidity, and expanded trading windows could significantly accelerate institutional participation in the RWA space.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.