Hedera (HBAR) edged higher toward $0.1372, supported by a steady rise in interest from public-sector and enterprise partners. The price movement comes during a period of tight technical consolidation, suggesting that the market is positioning for its next decisive phase.

HBAR Stability Near Support Highlights Renewed Demand

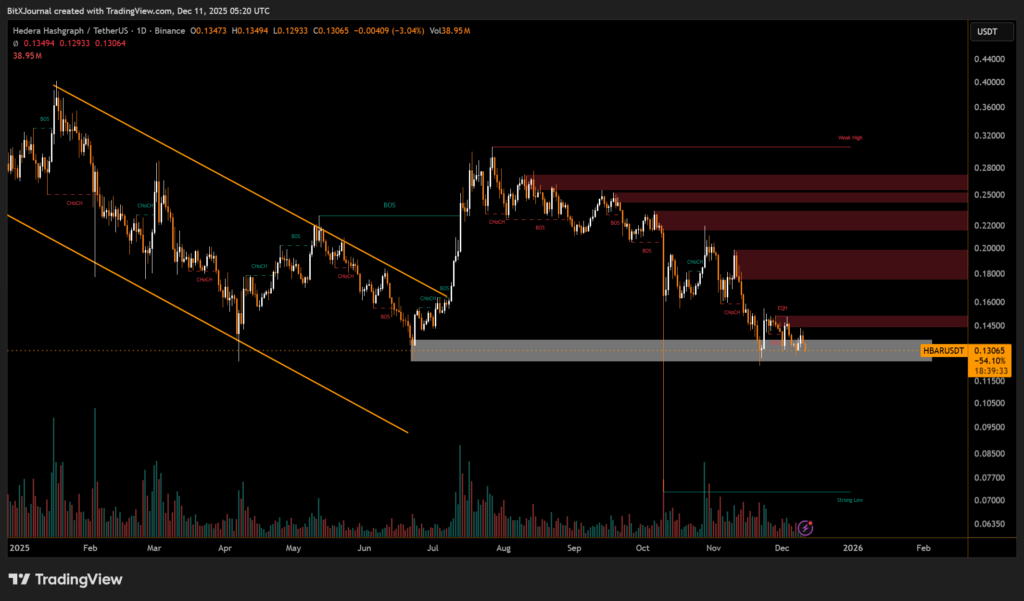

Price action on the daily indicates that buyers are protecting the $0.12–$0.13 demand zone, an area that has repeatedly acted as the foundation for short-term recoveries. The latest rebound of roughly 1.8% reflects modest but consistent accumulation, even as overall market sentiment remains mixed.

Trading volumes, while not surging, show sustained interest near the lower boundary of this structure. The chart also reveals several break-of-structure (BOS) and change-of-character (CHoCH) signals, confirming that momentum has slowed but not fully shifted against bulls. Sellers have failed to push the asset below its multi-month support, reinforcing the importance of this base.

At the same time, Hedera continues to attract attention from organizations exploring network-level tokenization and data-integrity applications. This steady flow of partnerships has kept the asset relevant during periods of market hesitation.

Technical positioning aligns with the broader narrative: enterprise adoption remains a pillar of Hedera’s resilience, while the price holds within a zone where long-term buyers historically engage.

HBAR’s stability around core support, combined with ongoing institutional momentum, suggests the asset may be forming a foundation for a potential recovery if buying pressure expands.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.