Hedera Hashgraph’s native token HBAR slipped 0.6% to trade near $0.179 in Thursday’s session, reflecting an indecisive market tone as buyers and sellers battle for short-term control. The decline came after the token briefly held above a key intraday support near $0.185, only to break lower in the final trading hour.

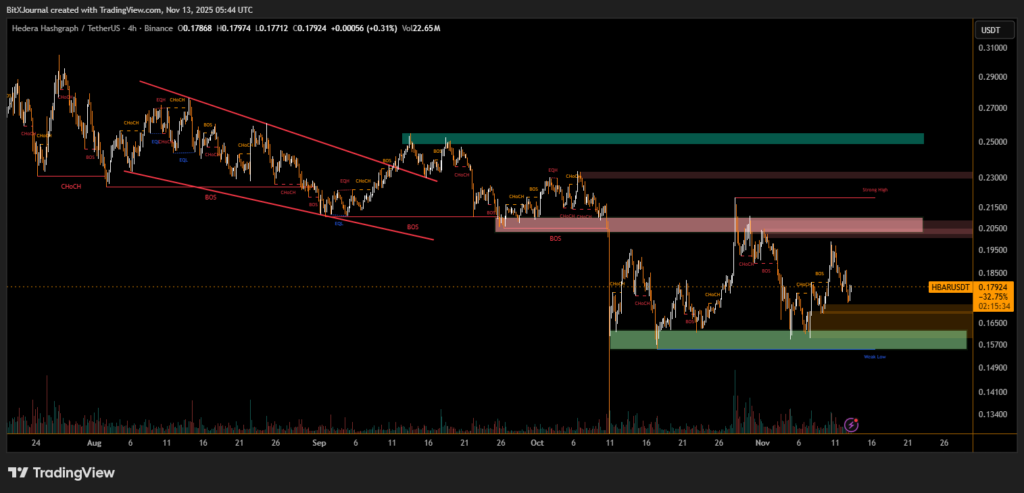

According to recent 4-hour trading data, HBAR has struggled to maintain upward momentum since failing to clear resistance at $0.205, a zone marked by repeated Break of Structure (BOS) and Change of Character (CHoCH) formations. Analysts note that this technical pattern suggests a temporary loss of bullish strength, though a rebound from the $0.165–$0.158 support region remains possible.

“The chart structure indicates an extended period of sideways accumulation,” said BitXJournal market analyst. “If buyers can defend the lower green demand zone, we could see a short-term recovery toward $0.19 or $0.20. But a clean break below $0.16 would expose a deeper retracement.”

Institutional Interest and Broader Market Context

HBAR’s pullback coincides with reports that institutional investors are rotating toward regulatory-compliant blockchain projects, signaling a cautious shift in sentiment. Despite the short-term weakness, Hedera continues to attract enterprise adoption interest for its energy-efficient consensus model and high transaction throughput.

BitXJournal digital asset strategist commented, “The fundamentals remain strong, but liquidity is thinner than usual. As long as the macro environment stays uncertain, tokens like HBAR are likely to trade within tight ranges.”

Key Levels to Watch

For now, $0.185 stands as an important near-term resistance, while $0.165 represents a critical support zone. Traders are advised to monitor volume spikes and structure shifts for clearer direction. A decisive move above $0.20 could reignite bullish sentiment, while sustained weakness below $0.16 may confirm a broader trend continuation.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.