HBAR Holds Critical Demand Zone Despite Heavy Selling Pressure

Hedera’s token extended its decline this week, mirroring the broader pullback sweeping through the crypto market. The move comes amid a noticeable spike in trading activity, suggesting that short-term sentiment has tilted further toward risk-off positioning. Despite the decline, HBAR continues to hover directly above a major support block that has historically attracted strong buyer interest.

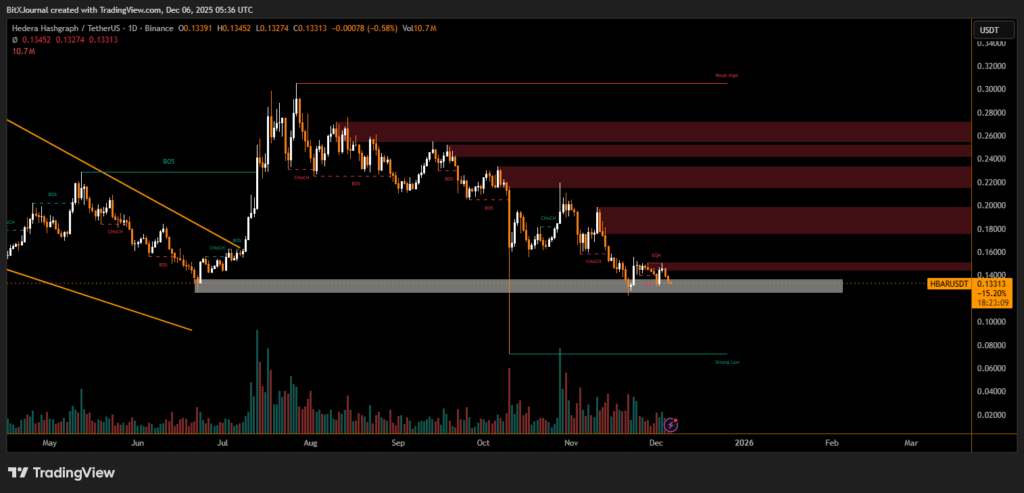

The market shows price repeatedly testing the $0.130–$0.135 range, a zone that has acted as a structural floor since late summer. Sellers pushed the token back toward this level after multiple failed attempts to reclaim mid-range resistance, marked by the layered supply zones between $0.160 and $0.260. These zones remain heavy with unmitigated orders, reinforcing the difficulty HBAR faces in attempting a sustained recovery.

Volume patterns also highlight a shift in market behavior. Recent red bars have expanded significantly, indicating stronger distribution as traders reposition away from higher-risk altcoins. Still, BitXJournal analysts note that the current demand region has consistently produced relief bounces, making this retest a pivotal point for determining near-term direction.

Speculation around new institutional products tied to emerging blockchain networks has helped fuel momentum across major altcoins, but HBAR has yet to reflect similar upside. Instead, it remains trapped beneath a series of lower highs, confirming the broader downtrend that developed through Q4.

Should the token lose its current support, attention will likely shift toward the deeper liquidity pocket near $0.085, identified on the chart as a major long-term low. Until then, the market will watch whether HBAR can stabilize above its final support band and repel further downside pressure.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.