Bitcoin suffered its largest single-day dollar decline on record, triggering widespread liquidations and raising concerns that a full recovery could take several years.

Bitcoin Price Crash Triggers Historic Liquidations

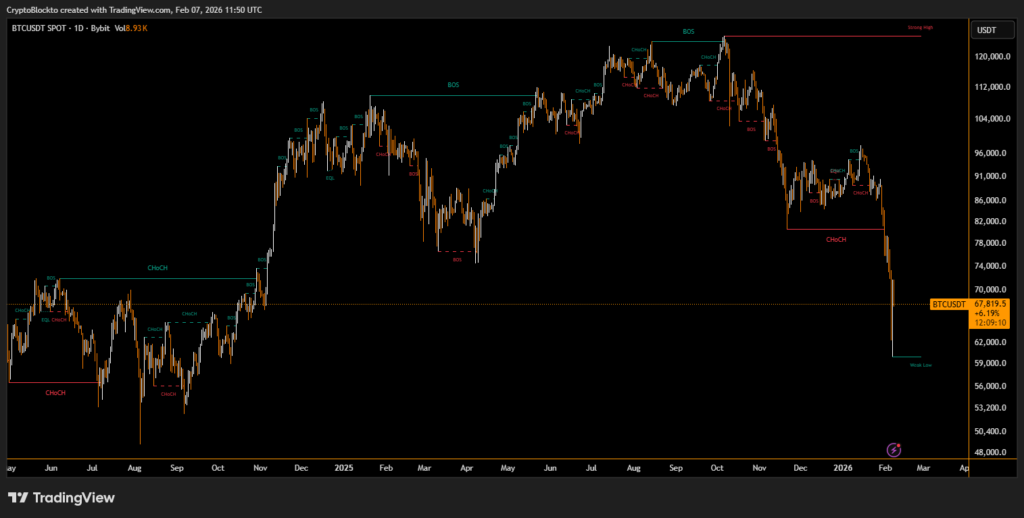

Bitcoin fell by more than $10,000 in one trading session for the first time, briefly dropping below $60,000 before stabilizing near $70,000. The sharp move liquidated approximately $2.6 billion in leveraged crypto positions within 24 hours, surpassing liquidation levels seen during the 2020 pandemic crash and the 2022 exchange collapse.

In percentage terms, the decline marked bitcoin’s steepest daily drop since the depths of the last bear market, underscoring the intensity of the selling pressure. Trading volumes also surged to their highest level in more than a year, reflecting panic-driven exits across spot and derivatives markets.

ETF Outflows Add to Selling Pressure

Institutional investors contributed to the downturn as U.S. spot bitcoin exchange-traded products recorded net outflows of roughly $434 million in a single day. Analysts noted that many ETF holders had never experienced a drawdown of this magnitude, amplifying short-term volatility.

Alex Mason said in X post;

Long-term cycle analysis suggests bitcoin may remain in a prolonged bear phase. Some models project 2026 as a full bear-market year, with 2027 focused on base-building. Under this framework, a decisive move back above $93,500 may not occur until 2028, when a broader trend reversal is expected.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.