Hyperliquid derivatives exchange, surged 24% within 24 hours following a notable increase in trading activity across silver, gold, and other commodity markets. This rally highlights the growing interest in crypto-backed commodity derivatives beyond traditional cryptocurrencies like Bitcoin.

Silver Futures Drive Volume

Silver perpetual futures on Hyperliquid became the platform’s third most active market during Asia trading hours, with $1.25 billion in volume and $155 million in open interest. The surge in trading activity is significant because Hyperliquid uses trading fees to buy back HYPE tokens, reinforcing a feedback loop that supports token demand and price growth.

Market Mechanics Fuel HYPE Demand

Hyperliquid’s model channels the majority of revenue from user-created markets into the Assistance Fund, which buys back HYPE tokens on the open market. As trading volume and open interest rise, more funds are directed toward HYPE buybacks, creating sustained upward pressure on the token’s price.

The spike in commodity trading signals a broader adoption of crypto derivatives platforms for non-crypto assets. Analysts suggest that diversifying beyond Bitcoin could enhance Hyperliquid’s long-term relevance, attracting traders seeking new avenues for speculation and hedging.

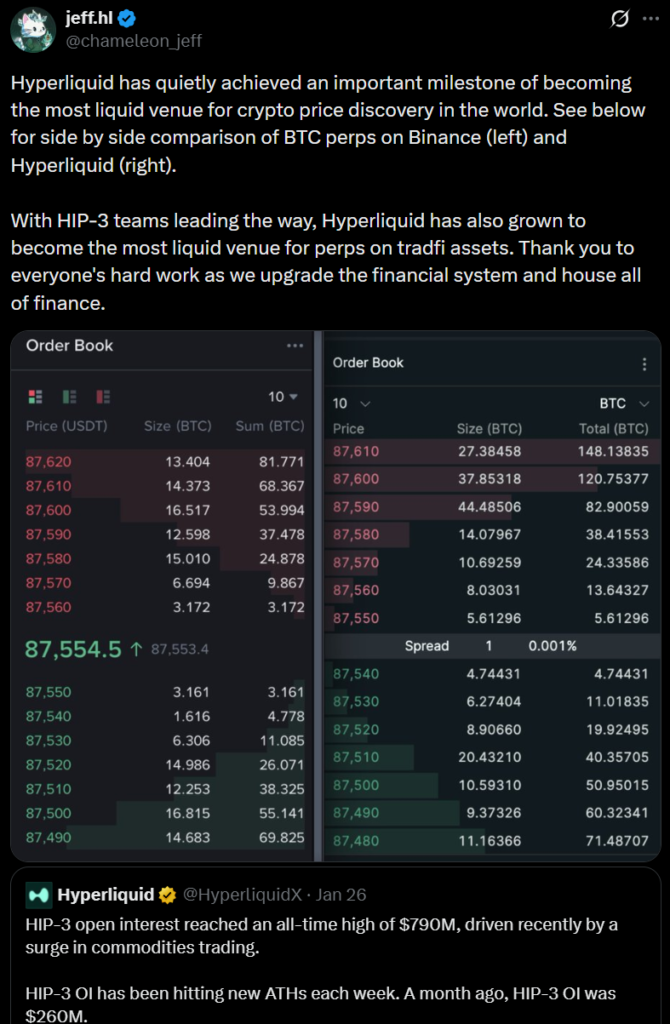

Jeff Yan, CEO and co-founder of Hyperliquid said in a post on X;

With increasing activity in silver and other commodities, the HYPE token rally underscores the potential of integrating digital assets with traditional markets, positioning Hyperliquid as a next-generation derivatives exchange.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.