Nasdaq-listed Hyperliquid Strategies Inc. (PURR) posted a net loss of $317.9 million for the six months ended Dec. 31, 2025, as declining token prices weighed heavily on its balance sheet. The loss was largely driven by $262.4 million in unrealized losses tied to its HYPE token holdings, reflecting broader volatility across digital asset markets.

Financial Results and Balance Sheet Overview

As of Dec. 31, the company reported total assets of $616.7 million and stockholders’ equity of $589.8 million, with no outstanding debt. In addition to token-related losses, results were impacted by a $35.6 million in-process research and development write-off linked to its merger with Sonnet BioTherapeutics and a $17.8 million increase in deferred tax expenses.

Revenue generation remained limited following the December merger close, with $0.9 million in interest income and $0.5 million in staking revenue recorded during the period.

HYPE Token Holdings and Treasury Strategy

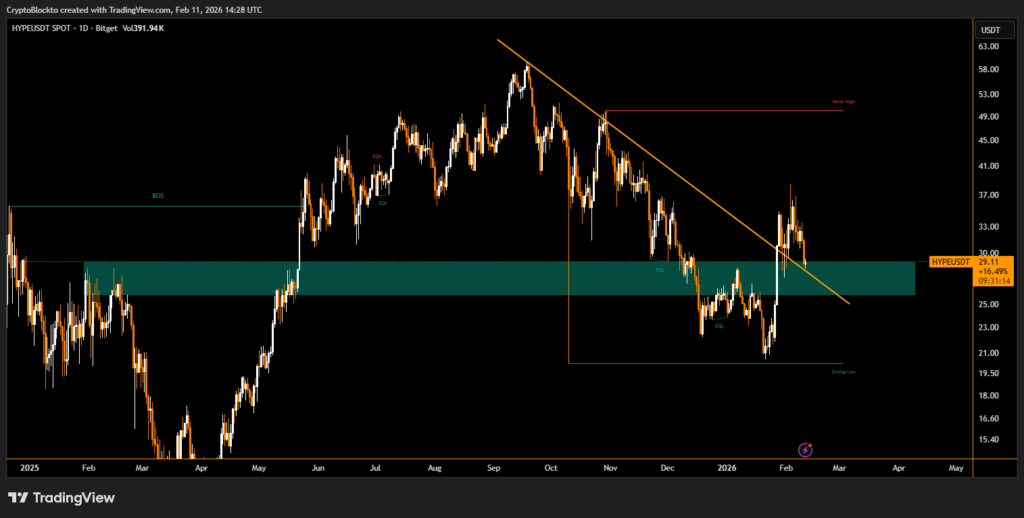

By early February, Hyperliquid Strategies had expanded its treasury to 17.6 million HYPE tokens after deploying $129.5 million to purchase an additional 5 million tokens. The holdings represent approximately 1.83% of the token’s 962.3 million supply. The company also repurchased 3 million shares for $10.5 million, reducing its fully diluted share count to 150.6 million.

Despite the recent downturn, management maintains that its capital position, staking yield potential, and access to a $1 billion equity credit facility provide flexibility for continued treasury expansion.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.