Illicit activity involving stablecoins hit approximately $141 billion in 2025, the highest level recorded in at least five years, according to a blockchain analytics report released by TRM Labs. The data shows that stablecoins played a central role in moving value for high risk actors, even as overall crypto crime did not necessarily grow proportionately.

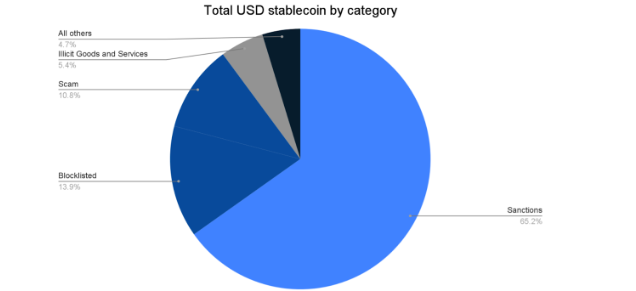

Stablecoins accounted for around 86% of all illicit crypto flows last year, driven largely by sanctions linked networks and structured money movement services. Roughly half of the illicit stablecoin volume about $72 billion was tied to the ruble-pegged A7A5 token, with activity concentrated in networks operating outside traditional financial controls.

Sanctions Evasion and Specialized Schemes Dominate Illicit Flows

The TRM report highlights that stablecoins are not uniformly misused, but have become core transactional rails for specific illicit categories, including sanctions evasion, guarantee and escrow marketplaces, and large scale laundering frameworks. Certain service sectors, such as illicit goods and human trafficking markets, showed near-total reliance on stablecoins, reportedly favoring their liquidity and payment certainty.

While the absolute dollar figure for illicit use reached a new high, it still represents a relatively small share of the total stablecoin transaction volume, which frequently exceeded $1 trillion in monthly transfers during 2025. The findings underscore both the growing integration of stablecoins into global finance and the targeted risks posed by certain networks and assets.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.