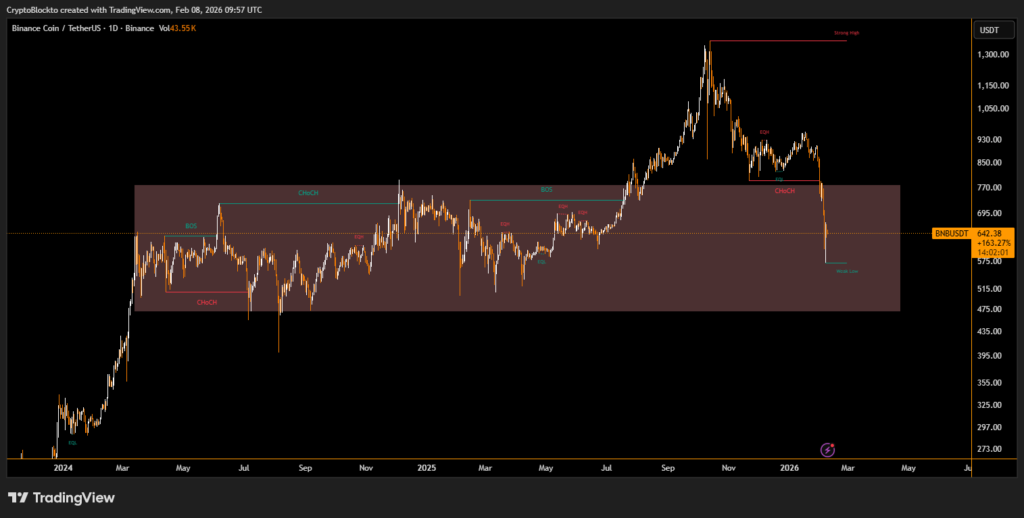

Binance Coin (BNB) appears to have re-entered a long-standing price range that has defined its market structure since March last year. Recent price action shows BNB falling sharply from its late-2025 highs and moving back into a consolidation zone that previously acted as both resistance and support for much of 2024 and 2025.

The range began forming around March last year after a strong upside move stalled. For several months, BNB traded sideways within a broad zone, with repeated reactions from the upper boundary near the mid-$700s and support holding in the $500–$550 region. This area saw multiple failed breakouts and breakdowns, confirming it as a high-liquidity range where buyers and sellers were evenly matched.

Breakdown From Highs and Return to Range

In late 2025, BNB broke above this range and rallied aggressively, eventually setting a strong high above $1,200. However, the move lacked sustained follow-through. The recent sharp decline pushed price back below former support, signaling a clear shift in market structure. Current levels around the mid-$600s place BNB firmly back inside the same range that dominated price action since March last year.

What Being Back in Range Means for BNB

Returning to a well-established range often suggests a transition from trending conditions to consolidation. Unless BNB can reclaim the upper boundary of this zone with strong volume, price is likely to continue oscillating within the range as the market searches for equilibrium.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.