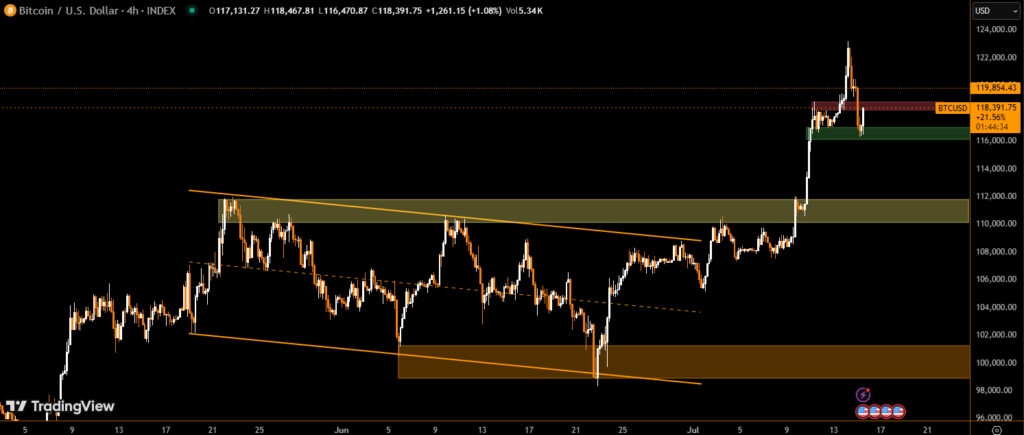

Prominent crypto trader James Wynn has made a striking return to the markets, opening a $19.5 million 40x leveraged long position on Bitcoin at an entry price of $117,000. This bold move highlights renewed confidence in Bitcoin’s near-term price trajectory. The position is currently sitting on an unrealized profit of $78,000, although Wynn has already paid $1.4 million in funding fees to maintain it.

If Bitcoin drops below $115,750, Wynn’s high-risk position will be liquidated.

$100K PEPE Long Shows Wynn’s Appetite for Risk

In addition to Bitcoin, Wynn opened a second position—this time on PEPE, the meme-based cryptocurrency. This 10x leveraged long was worth over $102,000, entered at $0.01201. The liquidation price for this position remains undisclosed, but it underscores Wynn’s continuing interest in high-volatility assets.

Wynn’s History of Liquidation

Wynn gained attention in late May when his first $100 million leveraged Bitcoin position was wiped out as BTC briefly fell below $105,000. He followed that with another $100 million long on June 3, which was also liquidated two days later, causing a loss of nearly $25 million.

“They’re coming for me again… Don’t let these evil bastards liquidate me,” Wynn warned on social media, suggesting market makers were targeting his liquidation levels.

Market Conditions and Sentiment

Leveraged trading uses borrowed capital to magnify potential gains—and losses. In March, another trader lost over $308 million on a 50x leveraged Ether position, showcasing the extreme risks involved.

Despite such dangers, Wynn claims that market makers are now “out of gun powder”, implying reduced downward pressure on Bitcoin’s price.

Opposing Views: Traders Short Bitcoin

While Wynn bets on an upward move, other traders disagree. A trader known as Qwatio has opened a 40x leveraged short worth $2.3 million, betting on Bitcoin’s decline. However, Qwatio has already been liquidated eight times in one week, losing $12.5 million.

Conclusion

James Wynn’s return with $19 million in leveraged Bitcoin positions and a $100K bet on PEPE shows continued belief in crypto’s bullish potential, despite previous massive losses. His moves reflect both the high risk and high reward nature of leveraged crypto trading—highlighting why such strategies are not for the faint-hearted.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.