In a bold regulatory shift, Japan’s Financial Services Agency (FSA) has proposed reclassifying cryptocurrencies as financial products, a move that could transform the country’s digital asset market.

The proposed changes would bring crypto under the Financial Instruments and Exchange Act (FIEA), the same legal framework that governs securities and traditional financial instruments like stocks and bonds.

Flat 20% Tax and ETFs on the Horizon

One of the most impactful elements of the proposal is a plan to introduce a flat 20% capital gains tax on crypto profits—replacing the current progressive tax system that reaches up to 55%.

This could dramatically lower the tax burden for active traders and long-term holders, making Japan a more attractive environment for retail and institutional investors.

The reclassification would also clear a path for the approval of crypto exchange-traded funds (ETFs), similar to those recently approved in the U.S., where institutional interest is surging.

Part of Japan’s “New Capitalism” Strategy

This regulatory push aligns with Japan’s broader “New Capitalism” economic initiative, which aims to stimulate growth through investment-friendly reforms and financial modernization.

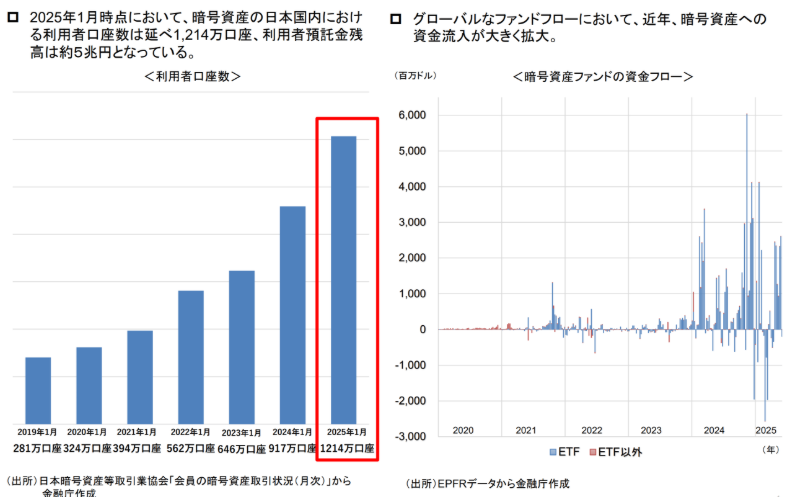

The FSA emphasized that crypto assets are now widely used and owned in Japan, with:

- Over 12 million active domestic crypto accounts

- More than ¥5 trillion (~$34 billion) in digital assets held on local platforms

- Crypto ownership outpacing traditional investments like FX and bonds among younger, tech-savvy investors

Institutional Momentum Accelerates Globally

The FSA also cited the rapid rise in institutional crypto engagement, noting that over 1,200 financial institutions—including US pension funds and Goldman Sachs—now hold US-listed spot Bitcoin ETFs.

Japanese regulators see an opportunity to replicate this growth locally by allowing similar investment vehicles under the FIEA framework.

Stablecoin Expansion Supports Broader Tokenization Goals

Japan is also expanding its regulatory support for stablecoins. In April 2025, major firms including SMBC, Ava Labs, Fireblocks, and TIS Inc. signed an MoU to explore stablecoin issuance pegged to the yen and U.S. dollar.

Additionally:

- In March, SBI VC Trade received Japan’s first license to handle stablecoins

- The firm is preparing to support Circle’s USDC, aiming to facilitate real-world asset (RWA) settlements like stocks and real estate via tokenization

Conclusion: Japan Aims to Become a Crypto Powerhouse

By redefining crypto as a financial product and lowering tax burdens, Japan is signaling a clear intent to become a global hub for digital asset innovation.

With supportive regulation, ETF pathways, and strong institutional momentum, Japan is well-positioned to lead the next wave of crypto adoption in Asia.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.