Debate over Jupiter Lend’s rehypothecation model reignites concerns about transparency and “isolation” claims as Solana lending rivals demand clearer disclosures.

Jupiter’s leadership is facing renewed scrutiny after acknowledging that earlier messaging about “zero risk of contagion” in its Jupiter Lend product was inaccurate. The admission has intensified debate across the Solana ecosystem about how the protocol’s vaults function — and whether users were given a clear picture of the risks involved.

Jupiter Admits Messaging Was Misleading

Jupiter executive Kash Dhanda confirmed that promotional posts describing the vaults as having “zero risk of contagion” overstated the design. He said the team removed the posts but should have issued a correction immediately. The controversy stems from Jupiter Lend’s use of rehypothecated collateral, a mechanism that boosts capital efficiency but links the fate of assets across vaults.

Dhanda insisted the vaults remain “isolated” in their configurations, with independent caps, liquidation thresholds, and penalties. However, he acknowledged that collateral can be reused in other parts of the protocol — the core point critics say undermines any claim of isolation.

Industry Pushback Over Rehypothecation

Kamino co-founder Marius Ciubotariu accused Jupiter of misleading users, arguing that any system allowing collateral to be reused necessarily exposes depositors to cross-asset contagion. He said the term “isolated vaults” was being stretched beyond its meaning, noting that rehypothecation introduces material systemic risk that should be clearly disclosed.

Other industry voices echoed this concern, calling the marketing language a serious breach of trust. Kamino had already blocked Jupiter’s migration tools over the issue and says cooperation will only resume once the messaging is corrected.

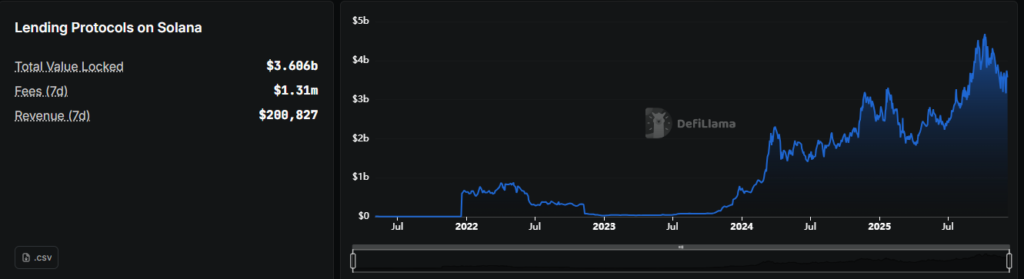

Risk Debate Intensifies as Jupiter Lend Surges Past $1B TVL

Jupiter Lend launched in August with high loan-to-value ratios of up to 90%, supported by a custom liquidation engine and what the team described as “dynamic limits to isolate risk.” Dhanda cited the protocol’s performance during the October 10 market crash, when billions in leveraged positions were wiped out, arguing Jupiter Lend generated no bad debt during the turmoil.

Competitors dispute that this track record is sufficient. Critics say the protocol is still far too new to be deemed battle-tested and must prove its resilience over multiple stress cycles.

Despite the debate, Jupiter Lend has rapidly grown to more than _ $1 billion in total value locked_, setting up a direct rivalry with Kamino, which currently dominates the Solana lending landscape.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.