Prediction marketplace Kalshi has expanded into institutional sports risk management through a new partnership with Game Point Capital, a broker specializing in sports performance bonus insurance. The agreement allows professional teams to hedge potential bonus payouts tied to milestones such as playoff appearances and championship runs.

CEO Tarek Mansour said onX;

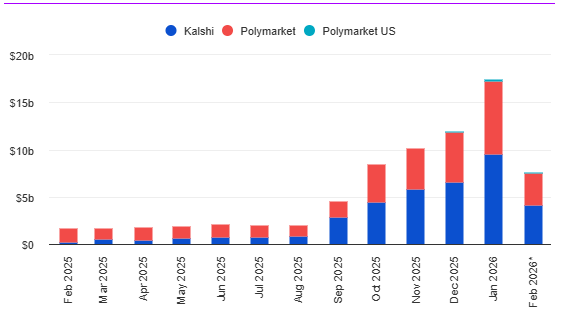

The move follows a record-breaking Super Bowl Sunday, during which Kalshi processed more than $1 billion in trading volume. The company also reported $9.6 billion in total trading activity in January, representing a 45% increase from December.

Game Point Capital, which issues hundreds of millions of dollars in sports insurance annually, executed its first hedges on Kalshi for two NBA teams. One contract covering a playoff bonus was priced at 6% on the exchange, compared to 12%–13% in the over-the-counter market. Another hedge for a second-round advancement bonus priced at 2% on Kalshi versus 7%–8% OTC.

Sports-related contracts have become a major driver of activity on prediction platforms. Trading volumes surged at the start of the NFL season in September 2025, with $441 million recorded in the first four days alone.

Despite rapid growth, the sector faces regulatory challenges. Kalshi is contesting state-level rulings in Nevada and Massachusetts, while broader legal disputes continue over whether federal oversight preempts state gambling laws.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.