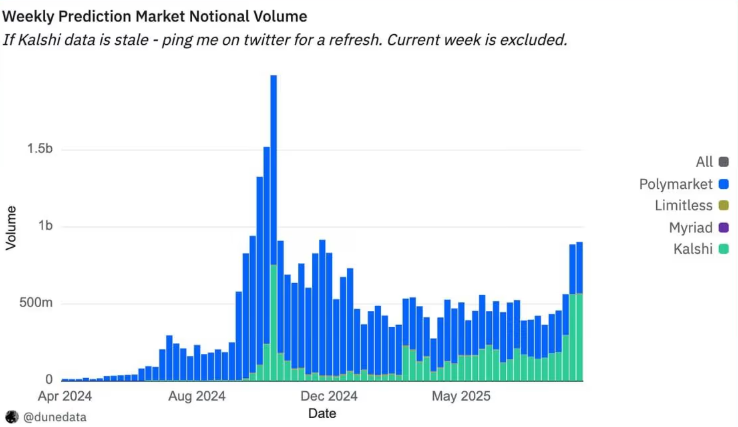

Regulated platforms compete as weekly trading volume crosses $500 million

The U.S. prediction market sector is experiencing rapid growth, with Kalshi pulling ahead of Polymarket in trading activity. Recent data shows Kalshi capturing a dominant share of volume, signaling a shift in trader preferences toward short-term, high-turnover contracts.

Kalshi Leads in Trading Volume

Between September 11 and 17, Kalshi recorded over $500 million in weekly trading volume, according to data tracked on Dune Analytics. The platform also held an average open interest of around $189 million, reflecting a surge in active participation.

In comparison, Polymarket registered $430 million in volume with open interest of approximately $164 million. While Polymarket continues to host longer-duration contracts, Kalshi’s users appear more active, executing trades at a faster pace.

“Kalshi’s lower open interest-to-volume ratio of 0.29 suggests quicker turnover and higher activity compared to Polymarket’s 0.38,” said one industry analyst, highlighting the contrasting trading styles of the two platforms.

Polymarket’s U.S. Push

Despite trailing in recent volume, Polymarket is making significant moves to re-enter the regulated U.S. market. The platform recently completed its acquisition of QCX, a licensed derivatives exchange, paving the way for compliant operations in the country.

Additionally, Polymarket launched earnings-based prediction markets in partnership with Stocktwits. These allow investors to hedge against company earnings surprises and enable analysts to measure sentiment in real time.

Experts suggest the divergence in strategies could benefit both platforms. “Kalshi is positioning itself as the go-to for frequent traders, while Polymarket is focusing on deeper markets that hold capital longer,” noted a market researcher.

The sector’s growth underscores the rising demand for regulated, transparent, and liquid prediction markets in the United States. With Kalshi now holding 62% of market share and Polymarket at 37%, competition is expected to intensify as both platforms expand their offerings.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.